The key to successful trading, if you are new to Forex, is having the basics correctly in place before trading with real money in live market conditions.

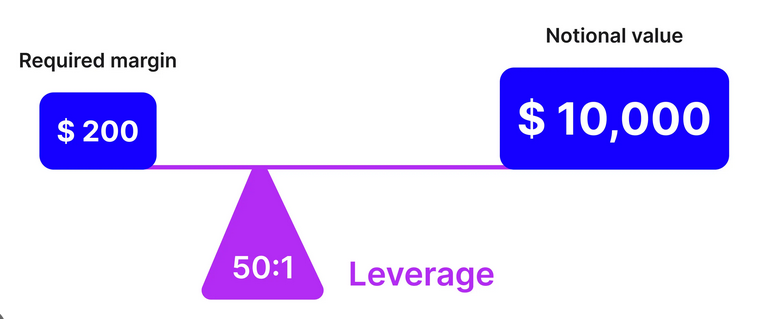

You must be well prepared to trade Forex as it is a volatile financial instrument for trading, affected by economic data, geopolitical events and major news announcements. Adding factors like leverage to the volatility, means an inexperienced trader without a trading plan has a reduced chance of success.

In this short article, we identify five steps that you can take, as a newcomer, allowing you to improve your chances of success from the outset.

Read on to find out how you can take the easy path to Forex trading!

1. Which Strategy Should I Consider?

Before you start trading Forex, it is essential to decide upon a strategy and not just enter the market blindly. Considerations should include:

Market analysis

Will you be more comfortable with technical analysis, fundamental analysis, or a combination of both?

- Technical analysis is the study of charts and patterns

- Fundamental analysis involves analyzing economic indicators and news events,

Trading style

Do you want to trade like a day trader, swing trader, or a position trader who takes long term positions? Day trading involves executing multiple trades every day; swing trading is holding trades for days or weeks and being a position trader means infrequent trade placement, instead focusing on trends over months and years.

Capital Availability

The funds you have available to invest will influence your strategy. Some strategies, like position trading require significant capital due to the need to hold a position long term with wide stop-losses. Other strategies like day-trading can be executed with a smaller budget, perhaps with low leverage as the aim is to make an overall daily profit with small profits on every trade.

2. What Currency Pair Are You Going To Trade?

Choosing which currency pair to trade is an important step on the easy path to Forex trading.

Some currency pairs like Cable (GBP/USD) are both volatile and liquid. They are well-suited for day traders looking for intraday profits as there is sufficient daily movement and there is good liquidity meaning tighter spreads and less slippage, which affects the paper thin profit margins of short-term traders.

Other currency pairs like USD/JPY are noted for being more stable. They have an inclination to follow long term trends which are suitable for position traders placing long-term strategies.

Whether it is GBP/USD, USD/JPY or another currency pair, it is important to follow them ahead of live trading until you have a good feel for price action and understand how they react in certain market conditions and to your selected technical indicators.

You will need to use charting software as part of your overall FX strategy, either a solution that is provided on your broker platform, or a stand-alone charting solution.

3. The Importance of Technical Analysis and Charting Software

Technical analysis is a vital skill to learn as a Forex trader. Presented visually, in the form of line, bars and candlesticks, charts supply price data on what is happening to a specific currency pair, and in most instances, the fundamentals reflect in the charts.

A widely held view is that a currency trader is only as good as the charting software they employ as part of a trading system. There are excellent stand-alone charting software tools on the market, and many can also plug straight into your brokers’ electronic trader platform, allowing trading placement straight from charts, with straight through broker trade execution.

Charting software is available to suit all trading styles and is an integral reason for the growth in popularity of online Forex trading. From manual charting software, to tools where you can code your own indicators and algorithms, the choice can appear overwhelming.

Good charting software includes:

- Trendspider, an AI-powered technical analysis tool to efficiently navigate and trade on the market

- TradingView, which is one of the best cloud-based charting software for access from anywhere

- eSignal is a software tool that uses multiple data vendors to give some of the best historical data analysis for strategy testing

For more information on the best technical analysis software including TrendSpider and TradingView, we provide more insight in our detailed guide on the best Forex charting software for traders, researched according to strict criteria to provide the best options out there for all trading styles.

An overview video of technical analysis – Charting patterns for beginners

4. Practice With A Demo Account

As a beginner, ahead of trading live, you should test prospective strategies in a simulated trading environment. Most online broker companies will allow you to open a demo account, without committing to trade through a live brokerage capital account.

Trading in a simulated environment is called forward testing. It allows you to trade safely any strategy that you have backtested using the historical data available through the backtester tool of your chosen charting solution. By forward testing a strategy through multiple trades that have already back tested successfully with historical data provides confirmation of the statistical expectancy ahead of trading live with real money at risk.

5. Ensure A Smooth Transition To Live Trading

The final step on your easy path to Forex trading is a smooth transition to live trading. Having successfully backtested with charting software, and forward tested your strategy on a demo account, there is the temptation to dive head first into live trading.

Good practice, however is to start small. Begin trading with a smaller trading size than you intended from the outset. It will help reduce psychological pressure and get you used to trading with real money as there will be an emotional difference, where the fear of losing real money can affect your decision making.

Try and also replicated the demo conditions as closely as possible in your live account, particularly risk management around tight stop-losses and keeping to the correct trading frequency by not over-trading.

Our Takeaway

In our five steps on your easy path to Forex trading, we identify that analysis will always be an essential element of your Forex trading strategy. If technical analysis is your chosen route then integrate the best charting software you can find as:

- The quality of data not only affects backtesting but has a knock on effect on forward testing.

- A greater likelihood of low latency when using direct broker trade execution straight from your chart.

Related Resources

Written by Chris Gillie

Chris Gillie is the founder of Axcess FX, a Forex software review and research website. He is a former investment banker who worked in FX Sales on the UBS London trading floor. Chris has been using Forex trading software as part of his trading set-up since the late 2000s and the embryonic days of MetaTrader and the MQL coding language.