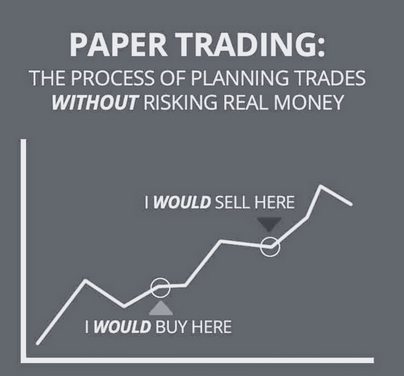

Simulated Forex trading, also known as paper trading or demo trading, refers to a risk-free environment where Forex traders can test strategies, study market dynamics, and navigate trading platforms with no risk of incurring real financial losses.

Here at Axcess FX, we have written this article to underline why, if you trade, it is vital to simulate all aspects of your Forex system, from strategy to execution, before trading with real money. A simulated environment acts as such a safeguard.

Read on to learn about the merits of simulated Forex trading and why it is crucial for traders of all levels.

Understanding Simulated Forex Trading

A simulated trading environment acts as a bridge, enabling traders to transition from theoretical knowledge to practical application. Seven key advantages of simulated trading compared to a live trading environment are highlighted here in Table 1:

| Advantages Of Simulated Trading Over Live Trading | Simulated Trading | Live Trading |

| 1. Fosters a deep understanding of market dynamics with no risk | ✔ | ✖ |

| 2. Engagement with real market data without financial exposure | ✔ | ✖ |

| 3. Allows for error and learning without financial repercussions | ✔ | ✖ |

| 4. Builds confidence in a trading system including trade execution & decision-making | ✔ | ✖ |

| 5. Develop, test and refine trading strategies in a secure and risk-averse setting | ✔ | ✖ |

| 6. Analyze and learn from trading results without actual financial implications | ✔ | ✖ |

| 7. Learn the functionalities of a trading platform before using real money | ✔ | ✖ |

Most reputable online brokers offer simulated Forex trading, each with a varying degree of features and user interfaces. We will cover this in the section about which platforms provide the best simulated Forex trading.

The Benefits Of Simulated Trading For Traders: In-Depth

In this section we will cover in detail, each of the seven benefits of demo trading identified in table 1.

Build a deeper understanding of market dynamics without financial risk

Simulated trading platforms allow traders to encounter market dynamics where currency movements, affected by geopolitical events and macroeconomic indicators, can be observed. Without the threat of real financial losses, traders can focus purely on market education including:

- Developing a real sense of market trends and patterns

- Navigation of varying market conditions and scenarios

- Understanding volatility and how to manage it effectively

Engage with real market data without exposure to your capital

Although actual capital is not at risk, simulated Forex trading is not just a hypothetical scenario; it is based on real-time market data.

Forex traders are still engaging with live market conditions and, witnessing first-hand how various currency pairs move in response to actual economic data and news events. Being an FX market participant without the risk of capital exposure still provides a genuine feel of the market’s nuances.

Allows for errors and learning due to the risk-free environment

Mistakes are an inevitable aspect of any learning journey. Unfortunately, mistakes in financial trading have consequences, namely a fall in capital on your trading account.

Within the safety of a simulated environment, currency traders can make errors without catastrophic consequences; instead, the mistake turns into a lesson that can be learned from. It nurtures growth, resilience, and a deeper understanding of trading.

Builds confidence in your trading system, including trade execution and decision-making

Continual practice in a simulated setting will solidify a trader’s conviction in their trading system. As they continually apply, test, and adjust their approach in a demo environment, confidence in executing trades and making timely decisions will grow.

Trader confidence, honed risk-free, is a significant advantage when transitioning from simulated to live trading. Compare this to a newbie trader throwing themselves straight into the pressure of a real money-at-stake environment with no practice. Indeed, the confidence derived from successful simulated trading:

- Reduces the likelihood of impulsive and emotionally driven decisions in the real market

- Prepares traders mentally and strategically for live market scenarios

Enables the development, testing and refining of trade strategies in a risk-averse setting

A simulated trading platform acts as a sandbox for Forex traders. Within its confines, you can:

- Develop new trading strategies

- Test and validate the effectiveness of strategies

- Make necessary adjustments and refinements based on outcomes

- Ensure that the strategy is robust and applicable to real market conditions

By optimizing their approach without financial setbacks, FX traders can ensure when trading with real money, strategies are well-calibrated.

Analyze and learn from trading results without financial implications

Post-trade analysis is a cornerstone of effective trading. In a simulated trading environment, a trader can dissect their performance, understanding both trade successes and failures. Without the emotional strain of real money at risk, this introspection is more objective and constructive, setting the stage for continual improvement.

Permits familiarization with trading platforms and tools

Every trading platform has its unique layout, tools, and features. Etoro has its own proprietary trading platform which is different to Interactive Brokers, which in turn is different to Forex.com. It is vital to master your chosen platform to maximize trading efficiency. Forex demo-trading accounts serve as a testing ground, giving Forex traders the time and opportunity to familiarize, practice, and master platform-specific functionalities; ensuring they are platform experts ahead of trading a live FX market.

What platforms offer the best simulated Forex trading?

Most reputable online trading platforms cater to the needs of traders looking for simulated trading functionality. Some of the notable ones include:

- Etoro: A broker with its own propriety Forex trading platform that provides demo trading accounts

- MetaTrader 4: A platform used by many online brokers in the U.S., including Forex.com and IG, and renowned for its user-friendly interface and comprehensive analytical tools

- Interactive Brokers has a proprietary platform called TraderWorkStation (TWS) with a simulated trading environment.

- TradingView: Known for its wide variety of technical analysis tools and social networking capabilities

Each platform comes with its unique features and capabilities, catering to different needs. For more details on Forex trading software including platforms, we have a written a guide here. Below is a useful video on how to paper trade on TradingView to provide further insight.

Drawbacks and Criticisms

Despite the obvious benefits we have identified, simulated Forex trading, it is not without its criticisms and drawbacks.

The lack of emotional involvement in a simulated environment can be a drawback and may:

- Lead to a lack of accountability for trading decisions

- Result in a skewed perception of trading risk and reward

Successful trading in the confines of a demo trading environment may result in overconfidence in live trading due to:

- Success in a risk-free environment not necessarily translating to live trading success

- Possible neglect of risk management strategies due to simulated success

There are limitations in simulating real market conditions and include:

- An inability to replicate the psychological and emotional pressures of live currency trading

- Potential discrepancies in data and market conditions between the simulated and live environments

A very good resource is available at Investopedia that further highlights not just the pros but also the cons of paper trading.

The Difference Between Backtesting and Simulated Forex Trading

Another type of strategy affirmation is backtesting, and like simulated trading is an important verification process used by traders before deploying a new Forex strategy in live trading.

Whereas simulated trading, is trading a non-live version of the current Forex market, backtesting is the use of historical price data to test a strategy and see how it would have worked in past market conditions. The two however, do work hand-in-hand.

The MT4 and MT5 (Meta Trader) based platform used by many online brokers has their own strategy tester that can be used for backtesting with historical data. It has a 90% modeling accuracy and although useful is not as reliable as the 99% accuracy available through external backtesting software that interprets data, such as Birt’s Tick Data suite.

Many traders will use both testing methods. They will put a prospective Forex strategy through a rigorous backtesting trial to see if it is profitable. They can then undertake further diagnostics by putting the strategy through it’s paces in a simulated market environment using live current market prices. The trader can then adjust and improve the performance of the strategy, all in a safe no risk environment.

A notable concern with backtesting is overfitting. Overfitting happens when a strategy is fine-tuned to perfection on historical data but fails to replicate those outcomes in real-world markets.

We have an in-depth written resource here at Axcess FX about backtesting as part of creating a profitable and reliable automated trading strategy.

How To Transition From Simulated Trading To Live Trading Effectively

We have identified four areas you should focus on to ensure a smooth transition from simulated to live trading. If you can adhere to them, you have given yourself every chance of making real money.

- Gradually introduce real capital into the mix by starting with a smaller than normal trade size. It will allow you to open the door to live trading while maintaining an even more conservative risk management strategy than you are used to.

- Continue to analyze and learn from a live trading experience instead of reducing focus on this important part of a robust trading system.

- Be mindful of the psychological and emotional differences between simulated and live trading. It may not be evident at first, but if you start entering and exiting trades without adhering to the rules of your tested strategy and risk management process then take a step back.

- Ensure all Forex trading strategies tested in a simulated environment are adaptable, with room for adjustment and not overfitted before you start trading live.

Conclusion

We hope that this article has convinced you of the merits of simulated Forex trading before moving into a live trading environment.

It is all too easy, especially for newcomers, in a desire to start making money quickly, not to build a reliable Forex trading system. Simulated trading is your safeguard to jumping the gun. If you combine it with backtesting you will be well placed for a chance at success.

Related Resources

Written by Chris Gillie

Chris Gillie is the founder of Axcess FX, a Forex software review and research website. He is a former investment banker who worked in FX Sales on the UBS London trading floor. Chris has been using Forex trading software as part of his trading set-up since the late 2000s and the embryonic days of MetaTrader and the MQL coding language.