The Forex market is highly volatile and Forex traders also need to navigate a complex web of variables to make informed decisions to trade profitably.

A trading journal is a crucial tool for successful Forex trading. It not only logs every trade, including the what, when and why behind every decision; it is also instrumental in analyzing and refining trading strategies to understand what works and also for dissecting the psychological aspects of trading.

Here at Axcess FX, we use trading journals rigorously and in this article, we will break down the importance of a trading journal in Forex for you in two parts. Firstly, how a trading journal is of benefit when you trade Forex and secondly, how to structure your trading journal to optimize its usefulness.

Read on to build your awareness of this vital Forex trading tool.

How Trading Journals Are Of Benefit When You Trade Forex

Trading journals provide four main benefits when you trade Forex, and we will look at each one in turn in this section.

1. A historical record of valuable of data

In Forex trading, the past can be a gateway to future success and a trading journal serves as a comprehensive database. By revisiting past trades, traders can recognize patterns and trends, gaining insights that are critical for sustained success or for shaping future trading strategies.

The journal also acts as a personal performance database. It reflects your journey as a trader, helping you identify areas of strength and aspects that need improvement; all contributing to a better understanding of the Forex market and your trading style.

2. A planning tool for strategizing each trade

Strategic planning is essential to trade Forex profitably and a trading journal emerges as a key instrument:

- A role in planning trades: Trading journals encourage Forex traders to think ahead, strategically plan entry and exit points, and avoid impulsive decision-making.

- Setting trade parameters: Journals help in setting clear parameters for each Forex trade, including risk tolerance levels, realistic profit targets and encouraging a disciplined and methodical trading approach.

With meticulous planning and thought, Forex traders can manage trading risk effectively and enhance the potential for profit.

3. An instrument for validating and refining trading strategies

A trading journal goes beyond its purpose as a trade record-keeper and it becomes an instrument for both validating and refining trade strategies.

Verifying trading methods

The journal provides a reliable validation platform to test the effectiveness of varying trading strategies over time, under different market conditions.

Analyzing Performance

Trading journals enable currency traders to review critically how their strategies perform, helping them to calibrate their methods to align with market dynamics. To be successful as a Forex trader, it is vital to evaluate and adapt continuously. It will help you maintain success and relevance in the ever-evolving Forex market.

4. Improving trading psychology

Psychology plays a vital role in Forex trading and a trading journal is a powerful instrument in shaping a currency trader’s psychological framework in two important ways:

Developing constructive trading habits

When you reflect on trade outcomes by studying your trading journal, it encourages the development of both disciplined and confident trading habits.

Building confidence and managing emotions

A trading journal helps greatly to recognize and understand emotional triggers like the fear-greed cycle; allowing Forex traders to make increasingly rational and less emotionally-driven decisions.

How To Structure A Trading Journal To Optimize Its Utility

A well organized trading journal is pivotal for effective analysis and self-observation in Forex trading and to optimize its use, the journal should be properly structured.

Structuring for clarity and efficiency

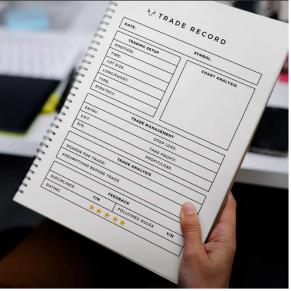

The trading journal should be split up into two clear sections.

Section one is for recording the details of each placed trade and serves as an objective log of your trading activities. including:

- The date

- Currency pair

- Entry and exit points

- Volume traded

- Any other quantitative data relevant to the transaction.

Section two serves to document your personal reflections as a trader and they include:

- The rationale behind every trade

- The emotional state of the trader

- Any market observations

- Any qualitative aspects that influenced the decision-making process.

The introspective part of a trading journal is crucial for understanding the subjective parts of forex trading, emotional responses and intuitive judgments.

Differentiating trading systems

For currency traders who utilize multiple trading strategies or systems, it is further advisable to keep separate sections or even separate trading journals for each approach.

Such a segregation helps provide a more accurate assessment of how effective each trading method is; from isolating the results of different trading strategies, you can better identify approaches that are the most profitable and under what market conditions they flourish.

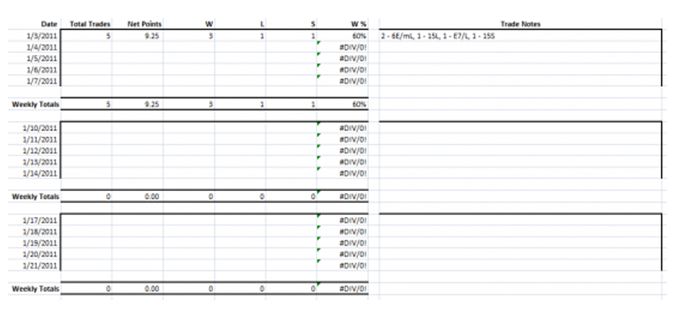

Expectancy formula for calculating trading success

The expectancy formula is a critical tool for evaluating the long-term viability of trading strategies that can be applied as part of your journal documenting process.

Applying the expectancy formula

The expectancy formula is a mathematical representation which calculates the expected average profit or loss per Forex trade.

It takes account of the average size of wins (average winning trade), the average size of losses (average losing trade), and the win ratio (the percentage of trades which are winners).

The formula is usually expressed as: Expectancy = (Win Ratio * Average Win) – ((1 – Win Ratio) * Average Loss).

Measuring long-term profitability

A constant application of the expectancy formula within your Forex trading journal offers a quantitative measure of the profitability of a strategy over time. It helps to distinguish between seemingly profitable strategies that may actually lose money in the long run and strategies that consistently generate a profit.

Making informed decisions

A Forex trading journal surpasses its role as purely a record-keeping tool; it is actually a valuable instrument for informed decision-making.

- Better strategic decisions: A consistent and meticulous analysis of all your trades using a trading journal leads to deeper insights. The insights will guide you to better informed, strategic trading decisions, helping to refine your approach to the market.

- Increased confidence in trade execution: A detailed trading journal will build your confidence as a trader and confidence is central to effective trade execution. Confidence reduces hesitancy and the inclination for second-guessing your own decisions; a journal becomes a source of reassurance, confirming that decisions are the result of sound analysis and consistent methodology.

Final Thoughts

We hope our article has instilled a sense of what a crucial tool a journal is for Forex trading success; importantly, how it provides a structured approach for analyzing trades, refining strategies, and understanding the psychological impacts of trading.

Other Forex Trading Insights

Written by Chris Gillie

Chris Gillie is the founder of Axcess FX, a Forex software review and research website. He is a former investment banker who worked in FX Sales on the UBS London trading floor. Chris has been using Forex trading software as part of his trading set-up since the late 2000s and the embryonic days of MetaTrader and the MQL coding language.