The rise of the MetaTrader electronic trading platform and its capability to easily integrate external software developed using its MQL language has seen an explosion in automated Forex trading software available to buy.

There used to be a difference between a Forex robot and an Expert Advisor (EA) where an EA identified trade signals, while a robot both identified and then placed trades without trader sign-off. Nowadays, Forex software developers have blurred any distinction leading to both EAs and Forex robots placing trades automatically.

Automated trading enables Forex traders to set and leave a Forex robot to trade continuously according to pre-programmed algorithms taking both emotion and fatigue out of Forex trading. Trading results can be stunning when a well-configured EA is set up on a VPS to trade continually 24/5 to make money.

Our Guide Will Help You Select A Forex Robot With Proven Long-Term Performance

Here at Axcess FX, our mission is to do the heavy lifting for you. We have undertaken extensive research to provide all the information you need to make informed decisions about buying the best Forex robot. According to our strict review ranking criteria, we have listed the 20 best Forex robots currently on the market.

Reading our updated guide for 2026 will help you understand the key elements that make up a successful Forex robot and also the less desirable elements. Armed with this knowledge, you will fully appreciate our ranking criteria and why our top Forex robots list is robust and will help you avoid buying inferior quality EAs.

What Is The Ranking Criteria To Make Our Top 20 Best Forex Robot List in 2026?

Following detailed research, we have identified seven criteria that have shown to be significant in analyzing a robot’s performance. The requirements are listed below, and further on in the guide, they will be explained as part of broader considerations for those looking to buy the best Forex expert advisor.

| RANKING CRITERIA |

|---|

| 1. Only Forex EAs with a verified track record and track privilege on MyFXBook or FX Blue |

| 2. We only consider live accounts trading with real money, and not demo accounts |

| 3. Forex robots must still be live and operating now |

| 4. The EA profit factor must be more than 1.0 |

| 5. Monthly returns must be more than 1% |

| 6. Drawdown must be no more than 50% |

| 7. A verified performance of 150 trading days or more |

The 20 Best Forex Robots According to Our Ranking Criteria

Strict criteria have been employed to compile our top 20 Forex EA robots currently on the market in 2026. All displayed in the table below, performance is rounded up or down to make it easier to read. We have also filtered the table to rank by price, draw down, total gain, and other valuable indicators relevant to your trading style.

These metrics make up some of the critical considerations when evaluating the best Forex EA robots. Our default metric for ranking a Forex robot between 1 and 20 on the list is by the lowest draw down percentage, a measure of a low-risk strategy. Where the table’s draw down is the same between Expert Advisors, we then look at profit factor as a differentiator, a metric that is essential for confirming whether an EA is profitable.

| Rank | Forex Robot ExpertAdvisor | Cost To Buy | Initial Deposit | Total Profit | Total Gain | Month Gain | Draw Down | Profit Factor | Trade Vol | Trade Days | Acct Type | Full Robot Info |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

#1 | FX Stabilizer | $539 | $500 | $18,575 | 3715% | 3.13% | 12% | 1.84 | 4334 | 3549 | Real | Visit Website |

| 2 | FX Proctor Max | $489 | $1,000 | $4,339 | 433% | 17.07% | 13% | 3.28 | 464 | 323 | Real | Visit Website |

| 3 | FX Constant | $245 | $1,000 | $1,516 | 152% | 12.3% | 14% | 2.56 | 157 | 237 | Real | Visit Website |

| 4 | Forex Robotron Our full review | $297 | $50,000 | $612,187 | 1224% | 38.50% | 17% | 4.53 | 745 | 241 | Real | Visit Website |

| 5 | FX Quasar | $279 | $1,000 | $2,145 | 215% | 7.88% | 22% | 2.11 | 225 | 452 | Real | Visit Website |

| 6 | Happy Index | $329 | $2,000 | $4,043 | 282% | 5.36% | 27% | 2.35 | 429 | 768 | Real | Visit Website |

| 7 | Trend Matrix EA | $447 | $1,000 | $1,188 | 118% | 4.45% | 30% | 1.69 | 253 | 535 | Real | Visit Website |

| 8 | My FX Radar | $269 | $3538 | $4,308 | 124% | 6.55% | 30% | 2.09 | 260 | 418 | Real | Visit Website |

| 9 | Forex Gump EA | $199 | $12,000 | $33,646 | 708% | 6.9% | 33% | 1.86 | 17940 | 920 | Real | Visit Website |

| 10 | Happy Power | $325 | $37,000 | $16,765 | 961% | 4.78% | 36% | 1.6 | 23179 | 517 | Real | Visit Website |

| 11 | FX Goodway | $229 | $1,000 | $3,910 | 391% | 12.40% | 36% | 2.55 | 436 | 406 | Real | Visit Website |

| 12 | FX Parabol | $239 | $1,000 | $4,280 | 428% | 13.70% | 37% | 2.11 | 448 | 390 | Real | Visit Website |

| 13 | Omega Trend EA | $157 | $349 | $288 | 82% | 1.47% | 38% | 1.07 | 2409 | 1235 | Real | Visit Website |

| 14 | BF Scalper Pro | $157 | $1,000 | $2,693 | 287% | 1.66% | 39% | 1.23 | 4453 | 2469 | Real | Visit Website |

| 15 | Wall Street 3.0 Our full review | $247 | $1,000 | $1,868 | 186% | 6.53% | 39% | 1.15 | 877 | 500 | Real | Visit Website |

| 16 | Traders Moon | $219 | $6,017 | $4,978 | 473% | 2.07% | 41% | 1.73 | 4582 | 2559 | Real | Visit Website |

| 17 | Forex Flex EA Our full review | $349 | $129,267 | $88,494 | 75% | 11.3% | 46% | 3.12 | 40 | 159 | Real | Visit Website |

| 18 | FX Fastbot | $309 | $1,000 | $3,703 | 1663% | 5.84% | 48% | 1.69 | 5523 | 516 | Real | Visit Website |

| 19 | Forex Diamond Our full review | $187 | $3,354 | $184 | 53% | 0.52% | 49% | 1.01 | 14570 | 2450 | Real | Visit Website |

| 20 | My Forex Path | $235 | $1,000 | $7,141 | 714% | 17.4% | 49% | 2.77 | 402 | 390 | Real | Visit Website |

The 10 Most Important Considerations When Choosing The Best Forex Robot

Our extensive research in pulling together performance data from different data sources has enabled us to provide detailed information to drill down into different elements that make up the quantifiable data to rank Expert Advisors.

1. Verified real trading accounts

Are the best Forex trading robots profitable? In response, third-party account verification services are essential when researching an Expert Advisor’s performance. Providers of Forex verification include FX Blue and MyFXBook. These software tools will connect directly to MetaTrader 4 trading platforms provided by Forex brokers and the Forex robot trading account statements to verify trading performance.

Metrics such as profit, current balance and draw down are all verified to create an overview to understand a robot’s performance quickly. The performance chart screenshot above of FX Stabilizer from MyFXBook provides a snapshot of statistics pulled from MetaTrader 4 onto third-party software.

MyFXBook and FX Blue verify both demo accounts with Forex brokers that simulate trading and real Forex accounts that trade the markets live real-time. A demo account performance using a hypothetical balance or account size does not factor in actual Forex market trading conditions such as slippage, spreads, and liquidity when trading currency pairs like GBPUSD, USDJPY, USDCHF, USDCAD, or EURGBP.

When considering a Forex EA’s performance, real accounts with both a verified track record and tracking privileges are the best form of proof. Not only is the performance verified, but it also means it is less likely that an account has undergone manipulation for fraudulent reasons, which is easier with demo accounts

2. Trading day count

The more days that an automated Forex trading strategy has been running live on a verified real account, the more it provides comfort that the strategy employed by the Expert Advisor to find Forex signals is reliable.

We do not consider Forex robots with a track record of less than 150 live trading days (5 months) as having sufficient time recorded to sufficiently embed trading strategies. The average number of trading days in our 20 best Forex robot list is 951 days or just under three years.

As well as days traded, we also look to ensure that an Expert Advisor is still live trading right now. Some FX robots have verified trading days on their website from MyFXBook or FX Blue that confirms performance but relates to an account that stopped trading a currency pair three years ago.

3. Robot refunds

The best Forex robots are those that employ the services of digital retailers such as Clickbank to fulfill their customer orders. Digital retailers take care of all the payment processing, payouts, and refunds relating to a robot’s sale.

It allows the Forex robots developer to concentrate on what they do best which is developing, updating, and maintaining their Forex robot and not worrying about customer administration.

For buyers of a Forex robot, digital retailers provide comfort by offering a 100% money-back guarantee. The guarantee varies between 30 days and 60 days, meaning if you are not satisfied, you can ask for a refund. It allows a Forex robot to be thoroughly tested on either demo or live accounts to ensure it is the right EA for you.

4. Low draw down

Draw down is a crucial metric for a Forex trader and essential for gauging the risk level of the strategy coded into an automated Forex robot. Our best Forex robot table considers draw down and is one of our key ranking criteria.

Draw down is the decrease in the capital on a Forex trading account and results from loss-making trades. For example, if on one Forex trade, you lost 50% of your trading capital from $1,000 to $500, it will now require a 100% trading gain to get your balance back to $1,000. If the loss is recovered, the difference between the relative peak in the capital and the trough is 50%. The draw down is therefore 50%.

Such a significant draw down is avoided by employing a trading strategy with a well-thought-out risk/reward ratio – automated Forex robots developed through back testing historical data, including the past frequency of draw downs. An automated Forex strategy generates profits by reducing draw downs through the accurate placement of stop-loss and take-profit levels with a consistent set of extensively back tested rules.

An Expert Advisor with a high draw down percentage can mean higher gains and involves more risk measured by the decline and capital reduction. Our ranking criteria only consider FX robots with a verified draw down of 50% or below. The draw down is usually between 20% and 40%. A very high draw down may mean that there are issues with the algorithm coded into the Forex robot.

5. Monthly gains

What is the most effective metric to gauge the performance of a Forex robot over time? Many will look at the total gain in percent that a Forex robot has made since it started trading live on the Forex market. The green figure called ‘gain’ is at the top of the performance chart we have provided earlier in this guide.

The ‘gain’ metric problem is it does not give an insight into how the Forex robot is performing periodically during the period evaluated. For example, an unexpectedly large number of pips profit from a single trade might make up much of the total gain. Conversely, a significant loss may be an influencing factor.

Instead, the monthly gain is a much better barometer of the average benefits you can expect to make with the Expert Advisor regularly. It eliminates not being able to read whether a sizeable overall gain might be masking months of losses.

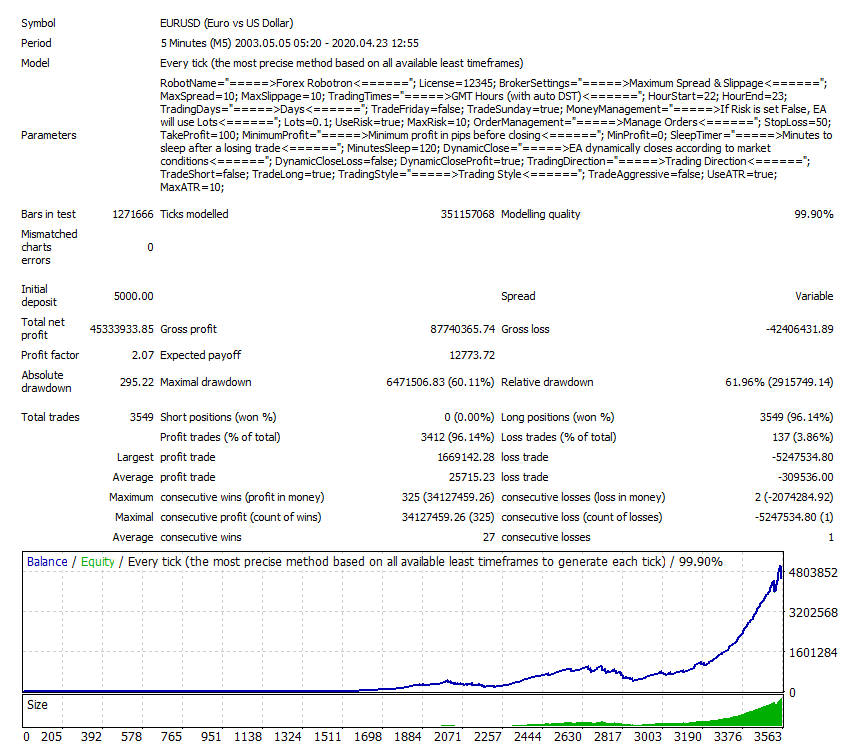

6. Solid back test results

Back testing is an essential part of developing a fully automated Forex EA by reinforcing as much certainty over its strategy’s likely success. Back testing trading strategies work because Forex trades that with past performance have performed profitably will continue to deliver profit.

When looking for the best Forex robot, it is vital to consider the accuracy of the modeling employed in back testing. A 99.90% accuracy compared to live currency market conditions is essential. It is achieved through sophisticated tick data tools such as Birt’s Tick Data Suite, which takes real tick data from Forex broker sources of historically recorded prices on a tick-by-tick basis.

When back testing any Forex trading strategies, a set of specific parameters must be applied to a collection of currency pairs’ historical price data, analyzing the results forms the base for the strategy by showing performance over a fixed period with the longer the period back tested, the better.

Robot developers that only use MetaTrader Strategy Tester as a base for back testing their trading systems should be open to question.

Below is a screen print of the Forex Robotron back test. Test results shown on the charting software screen print goes back 15 years and is undertaken with 99.90% modeling accuracy using actual price ticks.

7. Forex Robot Reviews

Reviews are an essential consideration before purchasing a Forex robot. Both review sites and forums provide access to the best Forex robot reviews. They provide trusted opinions from Forex traders using the automated software or professional reviewers that extensively research a robot to make an informed decision about the best Forex EA.

One of the best forums is Forex Factory. It has many members and active threads on the forum, with many focused on Forex trade systems.

Review sites are an excellent place to read Forex Expert Advisor reviews. FPA is a well-respected Forex expert advisor review site. Here at Access FX, we offer thoroughly researched Forex EA reviews that include studies of performance, strategy, price, set-up, key features, and customer support levels.

It is best not to take account of user reviews left on a robot developer’s website. It is questionable whether these are objective as it is not in the robot developer’s interest to leave up a negative Forex EA review that will impact product sales.

8. The cost – How much are Forex Robots?

Forex robots are typically available for purchase with a one-off upfront fee with free lifetime updates and ongoing customer support. It is less common for robots to be provided on a monthly or annual subscription, although this does exist.

According to our research of the top 20 robots, all have an upfront purchase price, with the average costing $287. The cheapest Forex robot is the BF Scalper Pro at just $157, and the most expensive EA is the FX Stabilizer that retails at $539.

When it comes to price, the cheapest is not necessarily the best Forex EA. For a developer to maintain and even update the robot software, there are development and ongoing costs. Is the developer who offers a low-cost robot likely to continually test the EA, develop it, and release new versions?

Forex trading robots may start trading using a profitable strategy, but without periodic re-calibration, as market conditions and trading rules evolve, they may become ineffective with a limited shelf life.

As well as releasing new versions to ensure that the EA keeps making money, glitches and bugs are also a problem that can cause downtime from trading. A good programmer needs to continually provide updates to ensure that functionality does not affect profitability.

In our up-to-date guide for 2024, FX Stabilizer for the second year running is the best Forex robot for performance but is also one of the most expensive; reinforcing that paying a bit more for an EA can pay off.

9. Customer support

When trying to find the best robot for Forex trading, the help desk assistance level is often an overlooked part of a purchase. Consider what happens if you are having problems with the installation process to work with MT4, you have questions about the robot settings, or the forex robot is not working. If the robot developers are not responsive in supporting their customers, it will be frustrating.

The best Forex robot developers have a responsive help desk service, available 24/7, often replying to customer queries within an hour, generally via email but sometimes through live chat support. Other developers offer a more limiting 24/5 service, so just providing support during the trading week and not at the weekends.

10. Profit factor

Does a Forex robot make money? A real trading account profit factor (PF) will answer this question and is a crucial metric when assessing whether to buy a Forex robot. The PF shows the interaction between profit and risk. The PF calculation divides all the winning trades’ profit by the losses on all the losing trades.

For example, if an EA makes a Forex trader a gross profit of $1,000 across all its winning trades and a total loss of $500 across all its losing forex trades, the PF is 2.0. The higher the PF, the lower the risk. A PF above 1.0 means the Forex robot is profitable, whereas an EA with a score under 1.0 should not be considered for purchase.

The Best Forex Robot According To Our Detailed Analysis

The top 20 best Forex robots identified through our in-depth research all show excellent performance adhering to strict criteria, including low draw down and a positive PF over a long period, all within a live real-time trade environment not simulated.

With a draw down of just 12%, combined with a strong PF of 1.84%, we consider FXStabilizer, overall, to be the best automated Forex trading robot currently available. It is a consistent performers and has topped our list for two years running. We think that Forex Robotron is also an excellent EA, with both a low draw down and sustainable profit factor and is the number 4 rated robot on our ‘best of’ list. Forex Diamond also has a long track record and features on our list.

If you want to find out more about FX Stabilizer, please click here to visit the official website.

Avoiding Bad Robots: The Number One Red Flag

From our extensive research of Forex robots, we would like to share the number one red flag that should be a concern when selecting an Expert Advisor, which is simulated or hypothetical performance.

Forex robots that can only demonstrate profitability through a demo account, also known as a simulated account, are hugely problematic in the EA market. These Expert Advisors have never been tested in the live currency markets with real trade executions and where market factors such as liquidity, spreads, and slippage can affect performance.

Even from MyFXBook and FX Blue, demo account performance can be manipulated as actual trades have never taken place. Simulated trading is such a concern that the CFTC themselves forewarn hypothetical performance presentations.

Here is a brief excerpt from the CFTC communication:

‘we warn of the limitations of hypothetical performance results and the dangers of relying upon these results as an indicator of actual performance.’

Effectively, simulated results do not represent actual trading. Our best EA list only uses real trading accounts with a verified performance from live trading.

Considering the Best Forex Robot – Takeaway

Forex EAs have received bad press due to robot programmers flooding the market with automated systems claiming outstanding performance without concrete evidence.

There are great robots available, however. Our 20 best Forex EA robot researched all show excellent performance adhering to strict criteria, including low draw downs and positive profit factors over a long period, all within a live trade environment and not simulated.

We hope that our in-depth best Forex robot guide has provided you with an understanding of what makes up a robust EA Robot and provides the necessary review knowledge to apply due diligence and confidently purchase an Expert Advisor that will work profitably for traders. If you also want to find out more general information about EAs, including what they are and how they work please read our Forex trading robot guide. We have also written a detailed 71 page e-book called “How To Trade Profitably With Forex Robots” published by Kindle and which you can take a look at by clicking the link on the book graphic below.

Written by Chris Gillie

Chris Gillie is the founder of Axcess FX, a Forex software review and research website. He is a former investment banker who worked in FX Sales on the UBS London trading floor. Chris has been using Forex trading software as part of his trading set-up since the late 2000s and the embryonic days of MetaTrader and the MQL coding language.