Did you know a significant factor that can reduce profitability for Forex traders is slippage as it directly affects the price at which trades are executed?

Forex robots use algorithms and automation to select and execute trades that can help mitigate the effects of slippage. In this article, here at Axcess FX we will look at how Forex robots handle slippage.

For even more information on Forex robots we have also written a guide on how to create a profitable trading strategy using FX robots.

The Evolution Of Forex Robots

Forex trading used to be a very manual process, with currency traders spending hours in front of screens, trying to catch the right market movements.

The trend has changed in the last decade with the growth of automated Forex trading helped by the development of the MetaTrader platform and MetaQuotes coding language (MQL). MetaTrader has allowed retail traders to not only enter the Forex market and trade with low cost and tight spreads (previously the preserve of financial institutions); but to also use algorithmic software compatible with MetaTrader-based broker platforms.

Forex robots with pre-programmed algorithms have become increasingly sophisticated. They are capable of analyzing complicated market data and executing trades with a speed and accuracy unmatched by human traders.

They have become an essential part of the FX trading landscape, offering traders of all levels a tool to streamline trading strategies and enhance market participation.

How Do Forex Robots Work

The primary purpose of Forex robots is to use algorithms to provide traders with the ability to execute trades at optimal times based on predefined criteria; thereby maximizing profitability and minimizing risk.

These ‘algos’ are predominantly based on technical analysis and sometimes fundamental analysis to make trade decisions. Their method of operating revolves around three areas:

1. Scanning the market: Forex robots scan the market for possible trades by analyzing price movements, trends, and patterns.

2. Technical analysis: Robots utilize different technical indicators to identifying trade entry and exit levels.

3. Trade Execution: Once a trading opportunity is found, the bot automatically places the trade for execution on a broker platform using trading parameters like trade size, stop loss, and take profit levels.

What Is Slippage In Forex Trading?

Slippage takes place when there is a difference between the fill price on a forex trade you place with a broker and the actual price the trade was executed.

What are the causes of slippage

In the Forex market, there are four main causes of slippage that have been identified:

1. Market liquidity

Liquidity is the ease with which a currency pair can be bought or sold. In highly liquid, major currency pairs like EUR/USD, it is easier to execute Forex trades at a designated price. In less liquid markets such as GBP/NZD it is harder to trade as there are less buyers and sellers and slippage occurs if there is not enough liquidity to execute a trade at a designated price.

2. The size of an order

The size of a trade order can be a direct cause for slippage in any FX market. Large orders may be hard to fill at a designated price as they may exceed the liquidity available in the market. Traders will resolve this by breaking up large orders into smaller ones to limit the effects of slippage.

3. Market volatility

Sudden changes in price can make it hard to execute trades at a preferred price and it particularly affects high frequency trading where timing is critical. If a limit order is placed to sell GBP/USD at 1.2600 but the market suddenly drops to 1.2500 before the order is executed the trade will have to be executed at a lower price resulting in slippage.

4. Latency

Latency is the time delay from when an order is placed to when it is executed. In algorithmic trading Forex trades are executed in a millionth of a second, and even small delays will result in slippage. Causes of a delay in order execution can range from slow processing speeds to network congestion on the relevant broker platform.

Understanding the different types of slippage.

There are three key types of slippage that you should be aware of:

Bid/offer slippage: Bid/offer slippage is a result of changes in the bid/offer spread of the relevant currency pair. It is normally from changing market conditions that a spread widens. For example, GBP/USD might typically be 1.2610/1.2611, a one pip spread between bid and offer. However in volatile trading, the spread might widens to 3 pips resulting in a higher trade execution price.

Trade execution slippage: Execution slippage takes place if the execution of a trade is delayed. The delay might be caused by technical issues on the trading platform, delays in processing the order or network latency. Ultimately, the actual execution price might be worst than the price requested.

Market impacted slippage: This slippage type takes place when the trade size is large enough to affect the market. Buying or selling a significant amount of a currency might cause the price to move away from the trader. For example, if a trader wants to buy a large amount of GBP/NZD, the increased demand may make the price rise, resulting in a higher execution price.

On a final note, slippage can happen in two directions, resulting in negative and positive slippage. For example, if you have a long USD/JPY trade and place a sell limit order at 150.20 but it is executed at 150.15, a negative slip of .05 has occurred.

Addressing Slippage With Forex Robots

Although slippage in the Forex market represents a major challenge for both manual traders and automated trading systems, Forex robots do offer the greater ability to minimize its effects compared to manual trading.

Monitoring market conditions and adjusting trade size

Automated trading software can be coded to monitor market conditions and react to a changing trade environment. Slippage is more likely to happen in periods of low liquidity and high volatility and a robot can include an algorithm to adjust trade size accordingly. Let’s look at market liquidity as an example:

- In markets with low liquidity, particularly cross currency pairs, trade size may be decreased.

- In markets with high liquidity and during peak trading hours, trade size could be increased.

Efficient use of limit orders

Limit orders ensure that trades are only executed at specified prices and reduce slippage compared to market orders where there is no control over price.

Forex robots utilize advanced algorithms to process large amounts of data, allowing them to continuously analyze market conditions. The analysis results in a higher probability of correctly predicting market price movements and setting optimal trade entry and exit points on limit orders that may be missed by a human trader.

Execution speed

The speed at which a trade is executed can impact on the degree of slippage suffered. Trade delays can be a direct impact. A broker platform with fast execution speeds combined with the automated trade placement offered by a Forex robot helps ensure that trades are executed quickly and efficiently.

Automated trade execution is far superior to the laborious trade placement of manual traders.

Use a low latency trading platform

A low latency trading platform means a faster data processing time. Latency is the time delay between an order being placed and execution. Low latency reduces delays in trade execution and improve the chances of getting a good price. The definitions of low latency vary from sub-milliseconds to sub-microseconds and low latency trading systems allow traders to react rapidly to market changes.

Backtesting

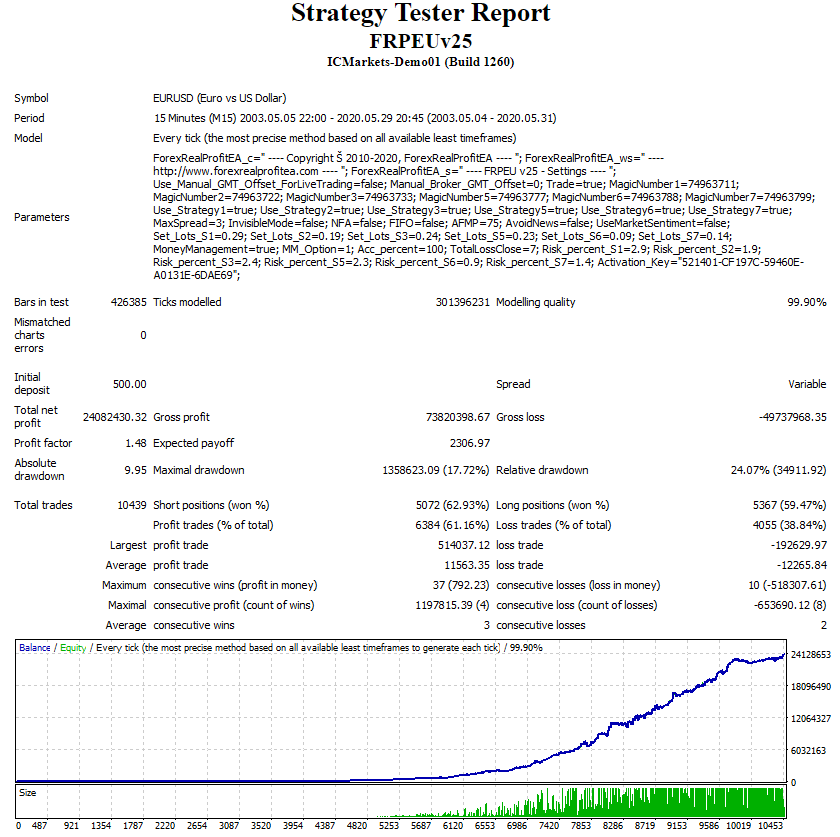

Slippage must be modeled and included in the backtesting process of a Forex robot especially high frequency trade strategies. To accurately test the performance of an algorithmic trading strategy for slippage, it should be done by using historical slippage data or by modelling slippage based on expected market conditions.

Data that includes slippage on a tick basis is vital to reach the 99.90% modelling accuracy that allows for an automated trade strategy to then perform well in forward testing ahead of going live in the market.

Reducing Slippage: Forex Robots Versus Manual Traders

In the table below is a comparison of how solutions to reduce slippage are managed by FX robots and those trading manually.

| Slippage Reduction Solution | Forex Robot | Manual Trader |

|---|---|---|

| Fast execution speed | A Forex robot can identify and place a trade automatically straight onto a broker platform for execution | Manual trade placements onto a broker platform result in slower execution |

| Limit orders | Identification of optimal entry and exit points from extensive data analysis | Limited data analysis resulting in less accurate limit order levels |

| Adjusting order size | An algorithm detects low liquidity and changes trade size automatically in microseconds reducing trade loss | Must change the order size manually to adjust to markets with low liquidity. The lack of speed may lead to slippage |

| Monitoring market conditions | Automated software can handle large amounts of data and monitor market conditions | A human trader is limited to what they can monitor and how rapidly they can react to market movement |

| Backtesting for slippage | Extensive tick data can be analyzed to factor in the effects of slippage in an algorithm | A limited level of backtesting due to an inability to analyze a large amount of data |

The Limitations Of Using Forex Robots

Although Forex robots have significant benefits over manual trading when addressing slippage, there are two limitations of using Forex robots in a wider context that you should be aware of.

- One drawback is a reliance on historical price data and predefined trading parameters. They may not always react to sudden changes in market conditions or unique events which can lead to sub-optimal trading choices.

- Any promise of profitability offered by using a Forex robot should be approached with realistic expectations; although Forex robots can enhance the chances of profitable trades, gains are not guaranteed because of the unpredictable nature of the Forex market

Final Thoughts

Forex robots are a powerful tool for traders looking to better handle the effects of slippage in the Forex market. With advanced algorithms and real-time processing capabilities they do provide a strategic advantage in efficient trade execution over manual trading.

Additional Resources

- What are common mistakes that beginners make with Forex robots?

- Drawdown and how it affects Forex robot performance

Written by Chris Gillie

Chris Gillie is the founder of Axcess FX, a Forex software review and research website. He is a former investment banker who worked in FX Sales on the UBS London trading floor. Chris has been using Forex trading software as part of his trading set-up since the late 2000s and the embryonic days of MetaTrader and the MQL coding language.