Forex day trading requires strict money management as the combination of high volatility and the leverage needed to trade profitably can result in rapid losses. Discipline makes a successful day trader, and it revolves around having a solid risk management process in place:

“You can have an average trade system but still make money through discipline. You can have the best trading system and software in the world, but without discipline, you will fail”

Currencies are affected by many economic, political and social factors every day which often leads to more volatility than stocks which adhere to more anticipated market cycles.

We will now look broadly at why it is vital to put in place a strict money management process before you start day trading Forex and the need to follow the process religiously.

The twin dangers of high volatility and leverage in Forex

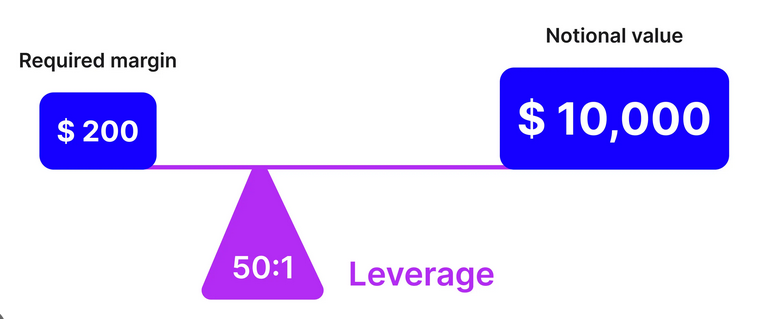

The Forex market is well known for its high volatility that can create rapid price movements. When you combine this with the leverage used by most traders to increase their exposure it magnifies both gains and losses.

The leverage is necessary as not many day traders will be able to place a trade of 250,000 EUR/USD trade using cash; yet by using leverage, they can get this same exposure with much less trading capital.

Strict money management is crucial when faced with this twin risk to ensure traders do not risk more than they can afford. Furthermore, in the US, for added protection, the CFTC and NFA allow Forex brokers to offer only a maximum leverage of 1:50 on the major currency pairs and 1:20 for minor currency pairs.

Preservation of trading capital

The central goal of money management is the preservation of trading capital to enable traders to continue to trade. Professionals will divide up their trading capital by staking no more than 2 percent on any single trade. If you lose on the first trade, you still have plenty more opportunities to get it right, even on a losing streak without depleting your capital account.

The tables below show the different results to your capital account from trading both with and without money management controls in place

| Percentage Of Capital Lost | Capital Lost From $50,000 Account | Return Required To Restore 100% Of Capital |

|---|---|---|

| 10% | $5,000 | 11% |

| 20% | $10,000 | 25% |

| 30% | $15,000 | 43% |

| 40% | $20,000 | 67% |

| 50% | $25,000 | 100% |

| 80% | $40,000 | 400% |

| Capital Account Size | Stop-Loss Order | Maximum Trade Loss |

|---|---|---|

| $10,000 | 2% | $200 |

| $50,000 | 2% | $1,000 |

| $100,000 | 2% | $2,000 |

Emotional decision making

The worst feeling is to over-gear or leverage on a trade and see the market go against you. You are now running an open position facing the twin emotions of anxiety and greed. When you enter a trade, when knowing the worst thing is losing 2% of your account, you remain sentimentally detached from the trade; your judgment will remain objective and decisions clearer on overall strategies, including entry and exit levels, stop loss and take profit points.

Money management not only shields you from significant losses but also helps you make rational trading calls based on fact and not fear, which increases profitability.

Taking trading profits out of your capital account

As a further control of your money management procedure, it is good practice to take profits out of your trading account. It stops the temptation to compound profits to capital; you may still be trading 2% of your trading capital, but compounding leads to trading more prominent positions which over time, could take you out of your comfort zone and affect your judgment.

Avoiding the “Big Trade”

For Forex traders, the attraction of a single large trade that could generate massive profits is strong but unfortunately undertaking such trades without strict risk management processes in place can lead to huge losses.

Money management is vital for removing the temptation to over-leverage on an oversized trade that may not pan out.

Learning from trading losses

Unfortunately, losses are an inevitable part of Forex trading, however, they can be turned into a positive learning experience when trading under a robust risk management system. After trading hours, a trader can analyze why a particular trade suffered a trading loss.

Since the loss will have been minimized to a tiny percentage of the trading capital the trader will be more objective than if they had suffered the loss of the entire trading account.

Money management styles

Irrespective of whether a Forex trader prefers to take on many small trades or a few larger ones over the course of a trading day, by applying a robust risk management regime allows them to apply their chosen Forex trading strategy consistently and effectively. These are both vital for long term trading success.

Leveraging uniform pricing

In Forex, as the transaction cost of a trade is usually built into the spread, the charge for opening a trade is the same irrespective of trade size. It allows Forex traders to leverage trades according to their money management system, without concern for increased costs.

It means traders can capitalize by gearing trade size up or down in a controlled manner.

The requirement for a structured approach

A structured approach to trading means that you have a trading system in place with clear entry and exit criteria and set stop-loss and take-profit levels. Having strict money management controls is integral to the trading structure as it dictates how much capital is at risk and how any profits are taken.

We highly recommend you watch this excellent video that explains about money management and trade psychology in great depth:

Summary

It is crucial to start Forex day trading on the right footing and having the right system and procedures in place to minimize losses is crucial if you want to become a successful currency day trader. Back in the 1990s there was the story of Barings Singapore who had no risk controls in place resulting in huge losses. By having risk management systems in place, as a trader you will remain in control.

As an accompaniment to this article, here at Axcess FX, we have written a useful resource on how to maintain focus and discipline when trading. We have also researched and put together a detailed guide with 10 key tips here that you will find useful to successfully trade Forex.

Finally, if you do have the opportunity, enroll on an online money management course to learn about self-control from a respected provider like Udemy.

Written by Chris Gillie

Chris Gillie is the founder of Axcess FX, a Forex software review and research website. He is a former investment banker who worked in FX Sales on the UBS London trading floor. Chris has been using Forex trading software as part of his trading set-up since the late 2000s and the embryonic days of MetaTrader and the MQL coding language.