While Forex robots offer convenience and efficiency for trading the Forex markets, they also come with inherent risks, making security of paramount concern.

In this article, we will look at what security measures you should take when using a Forex robot including both essential and advanced security steps. The article is of particular relevance for traders who are purchasing off-the-shelf Forex robot software, although there is relevance for advanced traders who code their own automated trading software in MQL4 or other coding languages.

The aim, as always, here at Axcess FX is to help you make informed decisions, in this case to help limit any potential adverse situations when using Forex robots.

Overview Of Forex Robots

Forex robots are software programs designed to automate trading decisions. They operate based on pre-set parameters or algorithms to execute trades.

These robots analyze market data, identify potential trades, and execute transactions without human intervention; they can work 24/7, reacting to market changes instantaneously. Traders can customize the settings of Forex robots to align with trading strategies, risk tolerance, and goals.

The Importance of Security In Forex Robot Usage

The use of automation tools like Forex robots in FX trading can be a valuable accompaniment as part of a trader’s wider trading system. They also come with inherent risks, which we broadly outline in the table below. Given these types of risk the implementation of robust security measures is not just advisable, it is essential.

| Risk Type | Description of Risk | Mitigation Of Risk |

|---|---|---|

| Vulnerability to Hacking and Fraud | Automated systems can be a target for cyber criminals. Poorly secured Forex robots can lead to unauthorized access and financial loss | Robust security measures will safeguard your FX trading accounts from any cyber threats and software malfunctions |

| Software Reliability | There is the risk of software malfunction where a glitch or error in the robot algorithm may result in unintended trades or large losses | Proper security also means ensuring the robot functions as expected and maintains consistent performance without unexpected disruptions |

| Market Risk | Forex markets are highly volatile and even robots with sophisticated algorithms cannot always predict or react as expected to sudden market changes | Knowing that your trading tool is secure allows you to monitor your robots performance with ongoing checks rather than worrying about technical vulnerabilities |

Essential Security Measures

There are a number of basic security measures that you should be aware of that will greatly mitigate the risk associated with using a Forex robot.

1. Only consider reputable Forex robots

Selecting a reputable Forex robot is the first fundamental step for both the success and security of your trading activities. To assist with the selection, there are several indicators to pay attention to:

Reputation and track record

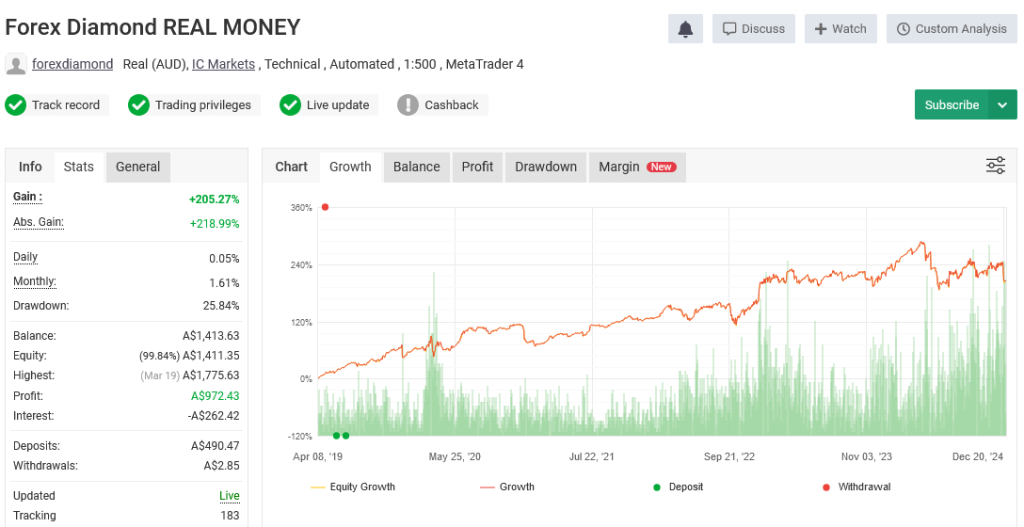

You should always opt for Forex robots with a solid reputation and a proven track record like FX Stabilizer or Forex Diamond. A solid reputation can be evidenced from respected review sites like Forex Peace Army and Trust Pilot and from other traders in forums and discord channels. It is not wise to base decisions purely on testimonials on the Forex robot developer’s own website. To assist you further, we have also spent a lot of time creating a guide of the 20 best Forex robots currently available.

Transparency

Reputable Forex robot providers are transparent about their algorithms and performance. A description of the algorithm and how the strategy works should be freely available on the robot website.

Verified performance figures from a live trading account are essential. Popular tools where these should be documented is on MyFXBook or FXBlue, two respected performance verification services. We have written a dedicated article on the importance of MyFXBook as a tool for establishing the credibility of Forex robot software.

Customer support

Well-known Forex robot software should provide a robust customer support service. A 24/5 service should be the minimum for addressing customer queries by voice, chat or email and ensures you have assistance when needed.

Avoiding Scams

Be wary of Forex robot software offering unrealistic returns as it may indicate areas of concern in the algorithm. Concerns may include excessive leverage which can result in large draw downs. A good rule of thumb is to remember that if it sounds too good to be true, it probably is.

For more detailed guidelines on avoiding scams, refer to the CFTC’s Forex Fraud Advisory Page.

2. Testing on a demo account

Before committing real capital in a live trading environment, it is vital to test a Forex robot in a simulated environment, also known as a demo trading account.

A demo account allows you to gauge a robot’s performance in a risk free environment without real money being at risk. It is a safe space to trial different settings and see how the robot reacts to different market conditions.

In a test account you can undertake a performance evaluation to assess how an FX robot manages losses, its win rate, and how it adapts to changing volatility. The evaluation helps in understanding its reliability and efficiency.

3. Securing your Forex trading platform

Make sure the online Forex trading platform provided by your chosen broker is secure. It is fundamental in safeguarding your capital account from a possible hack and the loss of your funds.

- Strong passwords: Use complex and unique passwords for your trading accounts and change them regularly.

- Two-factor authentication: Enable two-factor authentication for an added layer of security as it significantly reduces the risk of unauthorized access.

- Secure internet connection: Always use a secure and private internet connection when trading as public Wi-Fi networks can be vulnerable to cyber-attacks.

4. Regular software updates and maintenance

An area often overlooked by inexperienced traders is keeping your forex robot and trading platform updated which is crucial for security and performance.

Regular software updates

Software updates often include security patches and improvements and by regularly updating your robot and trading platform to the latest version can protect against new vulnerabilities.

Maintenance checks

You should periodically check the robot for any glitches or issues as regular maintenance does help the software to run both smoothly and efficiently.

5. Understanding robot settings and configuration

The proper configuration of your Forex robot is essential for effective trading.

- Customization according to strategy: You should tailor the robot’s settings to better match your trading strategy and risk tolerance levels as incorrect settings can lead to poor trading decisions.

- Avoid over-optimization: Be cautious of over-optimizing the robot to perform according to historic market conditions; also known as over-fitting, it may not be indicative of future market behavior. The solution is to forward test the robot in a demo-trading environment.

6. Implementing effective risk management

Effective risk management is also key to successful Forex robot trading and there are three ways that constitute good governance.

- Stop-loss orders: Always set up stop-loss orders on every trade to limit any potential losses as it is crucial in managing risk effectively.

- Capital allocation: Only allocate a small percentage of your total capital to a single trade using the Forex robot; by minimizing your investment greatly reduces the risk.

- Balance and review: Regularly review and adjust your risk parameters to make sure they align with your current financial goals and market conditions.

Advanced Security Strategies

There are a series of advanced steps that can help you to further mitigate the risks associated with using a Forex robot.

Monitoring and intervention

It is vital to regularly monitor the performance of your Forex robot performance to maintain robust security and to optimize trading strategies.

Undertake Consistent Performance Checks

Undertake regular reviews of the trading history and performance metrics of your FX bot. It will help identify any anomalies or deviations from predicted behavior. For example, any continuous dips in profitability may indicate the robot algorithm is not reacting sufficiently to factors like changing market conditions.

Intervention Strategies

Always know when and how to intervene if the robot consistently under performs or behaves erratically; you should have a feel when may the time arrives to pause its activities, reassess any settings, or seek professional advice.

Raised awareness of scams and unrealistic promises

The Forex robot market can be susceptible to scams and unrealistic promises.

- Recognizing a scam: Be wary of any Forex robot that promises high profits or guaranteed returns with little or no risk as these are standard indicators of a scam.

- Research and verification: Always conduct thorough research to verify the credentials of the FX robot provider. Proof of credibility should include real performance results on third party verification services like MyFXBook. Reviews and feedback from other users on forums and discord channels is another source of comfort as is a strong rating on TrustPilot and FPA.

Using a dedicated trading computer

By utilizing a dedicated computer for Forex trading will greatly enhance your security in the following two ways:

- Reduced risk of malware: A computer dedicated to trading is less likely to be exposed to viruses and malware; because it is used solely for trading and not browsing the internet or downloading files online.

- Enhanced performance and security: A dedicated computer for trading can be better optimized leading to faster processing and stronger security.

Backup and recovery plans

Having in place a strong backup and recovery plan is vital for any Forex trader using automated trading systems.

- Regular backups: Back up your trading data on a regular basis so that you have the most up-to-date robot settings and historical data in case a system should go down from software failure or suffer data loss. Current backups will then facilitate the restoration of your trading system.

- Recovery strategy: You should develop a robust recovery plan; it should include all the steps needed to reinstall your trading platform, FX robot, and restore the settings from backups.

Additional Considerations: Invest In Learning and Professional Advice

Continuous learning and seeking expert advice are two vital steps for staying at the top of your game in Forex trading.

Continuous education

The FX market is fast-paced, and trading strategies that are currently profitable may not work in the future. By staying informed about trends in the market, economic developments, and advances in technology is critical.

Seeking expert advice

Consult with fellow Forex traders in forums and discord channels as they are a good knowledge base. There is also value in consulting with cybersecurity experts who can provide valuable insights into risk management, security best practices, and the latest trends in Forex trading technology.

Final Takeaway.

We hope our article has highlighted the risks of not having proper processes in place when utilizing Forex robots. FX bots can be an enhancement for your overall trading system; combined with the integration of stringent security measures they can lead to profitable Forex trading in a secure environment.

Written by Chris Gillie

Chris Gillie is the founder of Axcess FX, a Forex software review and research website. He is a former investment banker who worked in FX Sales on the UBS London trading floor. Chris has been using Forex trading software as part of his trading set-up since the late 2000s and the embryonic days of MetaTrader and the MQL coding language.