Forex, is an abbreviation for Foreign Exchange and refers to the global market where currencies are traded. As the world’s the largest financial market, it is central to global trade, economic growth and investment.

Market participants from governments to individual investors look to profit from currency moves or hedge against them. Forex is also an an important financial barometer as it influences economic policy and global economic stability.

The Size And Scope Of The Global Forex Market

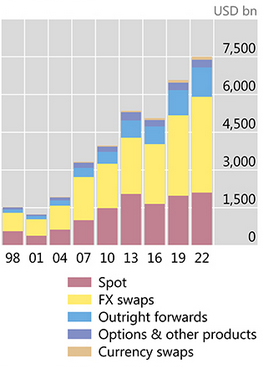

The global Forex market is the world’s most liquid and most significant market. In 2022 the daily trading volume in Foreign Exchange hit a record 7.5 trillion US dollars according to the Bank for International Settlements (BIS) in it’s triennial survey. The next survey will come out in 2025, where there is a reporting deadline of 31st August, but just to put the growth in Forex in perspective, in 1998, the daily volume was 1.5 trillion US Dollars illustrated in the chart below.

To put this huge figure in context against other markets, as of April 2024, the average daily trading volume of all the U.S. stock markets combined is 478 billion US dollars and the cryptocurrency market, 558 billion US dollars.

With the Forex market representing such massive daily turnover from continuous trading across multiple time zones and borders, it influences economies much more than other financial markets.

Key Forex Market Participants

There are several major players in the currency markets that all play an important role in the market. They are government central banks, major banks, financial institutions like investment funds and large corporations, brokers, sophisticated investors and retail investors.

Government central banks: The U.S. Federal Reserve and other central banks like the Bank of England (BOE) and Bank of Japan (BOJ) play a central role by setting interest rates and applying monetary policy which directly influences FX rates.

Major global banks and financial institutions: These market participants engage in high-volume Forex trading that impacts exchange rates through their speculative trades or hedging activities. Global Foreign Exchange banks with the largest volume include Deutsche Bank, Citigroup and UBS.

Brokers and retail investors: The advent of online brokers and electronic trading platforms has seen retail investors enter the market, as brokers now provide the same market access, that was previously limited to the large players. It also contributes to the Forex market’s liquidity and dynamism. In 2022, retail foreign exchange was 5.5% of all daily global Forex turnover and has continued its upward trend, now reported as over 6% in 2025. The largest online brokers include IG Markets, Forex.com and Etoro.

Currency Insights

Forex trading, is a 24-hour market operating across three trading sessions in Europe, the United States, and Asia. Although the trading sessions overlap, the major currency pairs of each market will have more volume during specific trading sessions. Major investment banks like UBS will trade the European session in London from 7 am until 5 pm, upon when the trading books are passed to the U.S. desk in New York. At the end of the U.S. session, the trading books are then passed to the Tokyo office and then passed back to London to complete the loop.

The Forex market can be traded 24 hours around the clock, but not quite 24/7, as Saturday is when no trading takes place in the major markets.

Currency prices can be very volatile, especially in emerging market currencies and cross currency pairs that tend to be less liquid. Factors affecting the movement of currencies include geopolitics, macroeconomic data, unexpected events such as catastrophes, market supply and demand and trade flows.

Currency pairs are crucial for Forex traders as they represent the value of one currency relative to another, offering profitable trading opportunities based on correctly predicting FX rate changes. Understanding the nuances of each currency pair is vital for effective trading.

The Most Traded Currencies And Pairs

Although there are more than 50 currencies traded globally, surprisingly, the market has relatively few major currencies that contribute to its significant daily trading volume.

Currencies that have a major impact on daily trading include Sterling, the Swiss Franc, the Euro, US Dollar, Japanese Yen, and the Australian dollar. These currencies are the base for around 18 currency pairs that dominate volume with the most traded currency pairs being EUR/USD, GBP/USD and USD/JPY.

Data from the most recent BIS triennial survey indicates that the US dollar was on one side of almost 90% of all Forex trades in 2022. Furthermore, almost 80% of all Forex trading occurs in major Forex trading hubs which are key financial centers and include London, New York, Tokyo, Singapore and Hong Kong.

The US dollars dominance is due to:

- A large presence in offshore funding markets where institutions raise debt with almost half of debt issuance being denominated in USD.

- The dollar is popular for global payments and international trade where around half is invoiced in USD.

Forex Trading Mechanisms

Foreign exchange sees currency pairs traded as one against the other. It means that when you buy one currency, you are selling the other currency in the pair. Currencies quote in pips, which are a percentage in points to four decimal places and represents 1/100 of one percent of a currency. The quotation system is entirely different from the securities markets where you either buy or sell a single stock, bond, or exchange-listed fund.

Compared to the thousands of individual stocks that we can buy or sell, the currency market also seems very slimmed down. All the major currencies are available in a variety of trading forms including spot and forward foreign exchange and derivatives, including futures and options.

Spot market: Spot Foreign exchange is where currencies trade at current market prices for settlement in 2 trading days and is the most liquid and popular instrument.

Forward foreign exchange: Forward FX is where currencies trade at current market prices but settle at a time in the future, like 3 or 6 months. The price is adjusted to take into account the time differential in interest rates between the two currencies in the pair.

Futures and options: Futures and options are derivative contracts (which means derived from the underlying currency pair) where margin or premium is agreed to buy or sell currency at a predetermined price at a future date.

Leverage also plays a key role in Forex trading as it allows traders to control large currency exposure with a small amount of capital, amplifying profits but also losses!

Strategic Approaches In Forex Trading

Success in trading Forex requires the ability to create strategies using techniques including fundamental, technical and sentiment analysis. Understanding and implementing these methods enhances a trader’s means to make informed trading decisions in a volatile market.

Fundamental analysis: This is the evaluation of economic indicators, geopolitical events and central bank policies all of which influence currency movements.

Technical analysis: The focus on using charts and mathematical indicators to predict future price movements based on previous trends in the market.

Sentiment analysis: Gauging the market’s mood and positioning through various indicators, assisting Forex trader’s in spotting potential market shifts.

If you are interested in learning more about Forex, below is an excellent video that covers all the basic knowledge to start you on your Forex trading journey.

RELATED RESOURCES

How Do Time Zones Affect Forex Trading?

How Are Investment Bank Forex Trading Floors Set Up?

Written by Chris Gillie

Chris Gillie is the founder of Axcess FX, a Forex software review and research website. He is a former investment banker who worked in FX Sales on the UBS London trading floor. Chris has been using Forex trading software as part of his trading set-up since the late 2000s and the embryonic days of MetaTrader and the MQL coding language.