As with all forms of trading, making money in FX is about having a trading plan that you have the discipline to follow. You must know your entry and exit points. Risk and reward must weigh up before you enter a trade.

Here at Axcess FX are our 10 top Forex tricks and tips to put you on the right path to trade profitably.

1. Get a Forex education

Forex trading carries the risk of losing your capital. To manage risk, put in place a working strategy, and avoiding significant losses requires solid FX knowledge. If you are committed to starting Forex trading, tip number one is to get a good Forex education.

From a basic understanding of how currency pairs work, you will want to learn how to analyze the market using fundamental and technical analysis and understand trading signals, trading tools, instruments, and study price action.

Beyond immersing yourself, online courses hosted or written by respected industry figures are essential. It is vital to learn the right way. They are also convenient for those that are in employment. UBS, the world class investment bank offer a one-day Forex course either as a classroom or virtual program which you can find out more about at their research academy.

Continuous education is also a necessity for experienced traders. Strategies may need refining, and keeping abreast of market and technological developments is essential. As an accompaniment, here is our useful article on the five steps needed to trade Forex.

2. Carefully research your broker

A myriad of online brokers exist. Choosing one can be time-consuming and confusing. Taking account of the following is essential:

- What trading platform and software does the broker use?

- Are you likely to use automated software to trade?

- Will this software be compatible with broker trading platforms?

It is critical to choose the right trading partner as you engage in the FX market since price, execution, and the quality of customer service can all make a difference in your trading experience.

Remember, if you are a US resident, you will need to use a CFTC registered Forex broker such as Forex.com, TD Ameritrade, Interactive Brokers, Oanda or IG USA.

3. Select a consistent strategy and goals

Once you have a Forex education, find a trading strategy, and stick with it to discover your trading style. FX Strategies range from the very basic to the very complex and from the aggressive to the conservative. Every trading style has a differing risk profile and a different approach for the strategy to work.

- Are you a position trader where you have the funds to take a long-term strategic trade?

- Are you a day trader due to limited funds and need to trade daily to make a profit?

- Will you be a disciple of technical or fundamental analysis or a bit of both?

- If you trade short term, consider a scalping strategy that requires instant decisions in the space of one trading period.

- Are momentum or reversal strategies a consideration?

- Are you a chartist and will trade with a moving average or Fibonacci strategy?

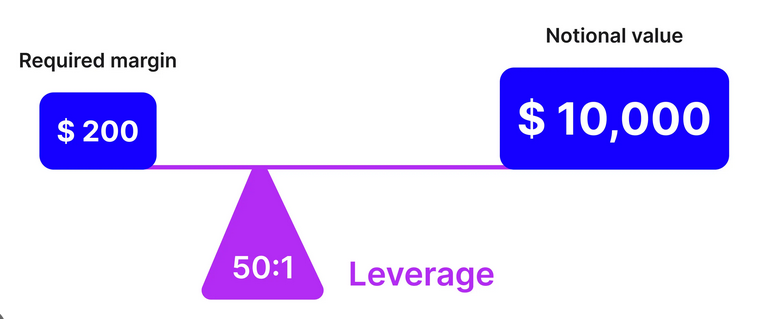

- What is your risk tolerance? How much leverage will you use?

- Will you trade using automated software, or do you prefer to trade FX manually?

- What currencies or currency pair(s) will you focus?

- Will you margin trade or make use of CFDs?

- What is the volatility of the currencies you want to trade as this will affect the strategy

Here is an excellent video detailing a simple profitable trading strategy

4. Use discipline and risk management

The management of your capital account is key to your success as a trader. Ensuring through appropriate stops that you trade with 1% to 2% of your capital at any time is essential if you want to last in the foreign exchange market. Every trade has an element of risk, and risk management will keep you trading for longer.

A lack of discipline can result in excessive trading losses, which can put you out of the game.

Panic and greed often blight the early stages of a Forex trading career. Controlling all emotions through risk management and recording it in a journal is excellent control overtaking a specific trading action.

Rules, discipline, and experience are critical in Forex trading. We have also written a dedicated article on how to further maintain focus and discipline when trading forex.

5. Create an intense work ethic

One of the most crucial Forex trading tips is a strong work ethic which means that you prepare well for every trading day or week through solid research.

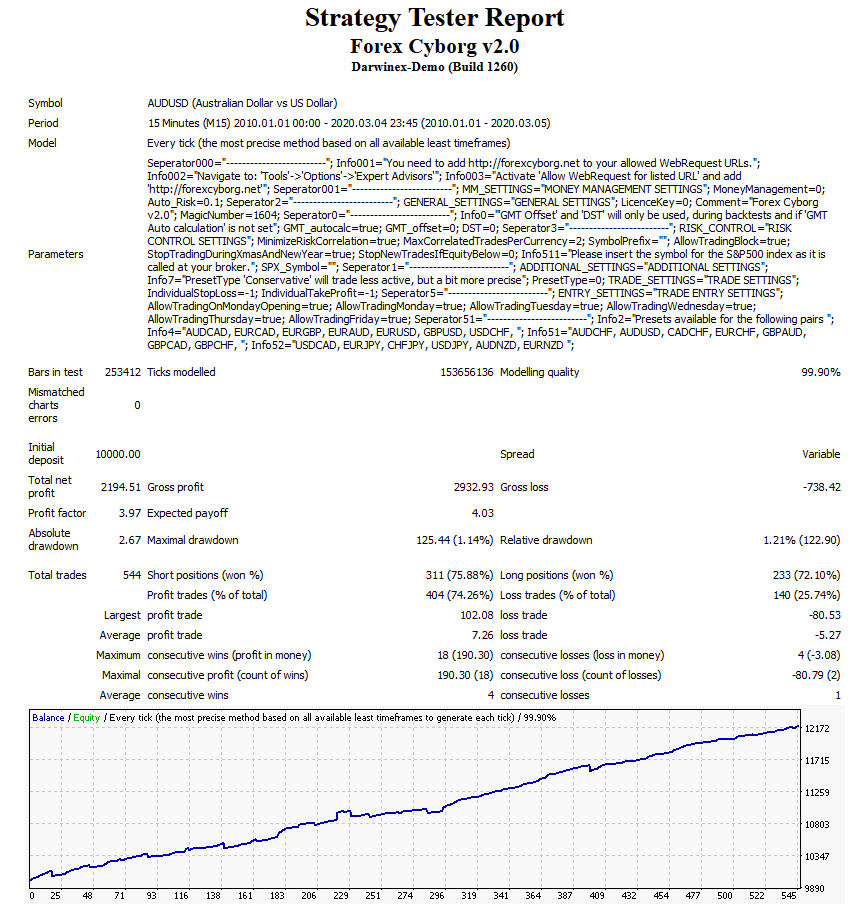

It means accepting that sometimes you may not feel like it but must take progressive action to improve continually. If you are trading through automation or mechanically, this may involve back testing your software or exploring new Forex trading strategies.

6. Accept losses

Look at the bigger picture and never obsess over having a high win percentage. Any loss should be easier to accept by limiting your trade exposure to no more than 1% or 2% of your capital. If you cannot take a loss, you will never be a profitable trader. Self-improvement and learning from previous mistakes build your character as a Forex trader.

7. Maintain a trading journal with weekend analysis

If you do not trade with discipline, you may be susceptible to revenge trading. A significant loss can trigger ill-disciplined traders to open up a new position with no strategic thought acting purely on emotion.

Operating a trading journal is essential, as successful currency traders are also accurate record keepers. It is vital to evaluate your trading performance continuously.

Note keeping should include:

- Entry and exit conditions of all trades

- Support and resistant levels

- Target levels for each trade

- Daily ranges

With meticulous note keeping, a journal helps to evaluate why you made losing trades and to monitor the ongoing performance of your trading strategy. It also flags up any inconsistencies with trades being out of line with your Forex trading strategy.

A journal can also be a printed record of an underlying chart if your strategy uses technical analysis. Entry and exit points and emotions at the time can record on the chart.

Our Top Trading Trick

Evaluating your journal at the weekend is a useful tip. The Forex markets are closed, and it will not interfere with your weekday trading and may allow you to be more objective; remember during the weekend you are more likely to be calmer than in the cut and thrust of a trading day.

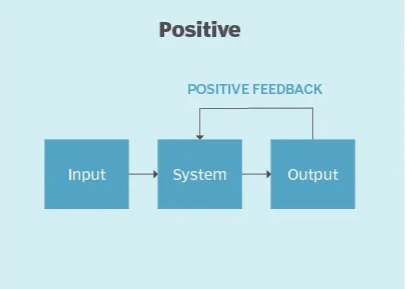

8. Positive feedback loops

Essential for building confidence, positive feedback loops are proven to work—trading according to your underlying strategy and executing well a pattern of positive feedback forms. Success builds confidence, and the more times you have winning trades in your chosen strategy, the more significant the positive feedback loop.

9. Carefully consider entry and exit points

Forex traders continually blight by conflicting information on charts of different time frames. A selling opportunity on a weekly chart may reflect as a buy signal on a daily chart. Make sure you synchronize a daily chart to time the entry against a weekly chart displaying trading direction. Only sell when you have a sell signal on both time frames.

10. Do not overtrade and take regular breaks

If you are over-trading the Forex markets, it is usually an indication of two underlying issues that may even be happening at the same time:

- You are likely to be risking too much capital with every trade.

- Your trading frequency is too high relative to the trading session.

Overtrading can harm your capital account. Trading Forex can be draining, and if trades are not going your way, a tendency is to spend long sessions in front of a computer looking at multiple screens that are central to a trading set-up.

To counter this, take regular breaks. It is vital to try and keep sessions uniform and take frequent breaks away from trading Forex and collect your thoughts. Only return to your trading station once you are feeling refocused.

Bonus Tip

We have highlighted ten Forex trading tips and trading tricks that experienced traders use to profit from the Forex market successfully. However, the ability to trade FX profitably depends on having substantial knowledge and a rigorous Forex trading system in place. Emotion is the bane of traders, especially those new to the market. By eliminating it through discipline and rules is a solid base on which to perform.

Many top traders deal with emotion in different ways. Our final tip is to use meditation techniques before your trading day to start trading in a peak emotional condition.

If you are interested in further trading insights we have written an article on Forex trading tips and one on how you can make money Forex trading.

Written by Chris Gillie

Chris Gillie is the founder of Axcess FX, a Forex software review and research website. He is a former investment banker who worked in FX Sales on the UBS London trading floor. Chris has been using Forex trading software as part of his trading set-up since the late 2000s and the embryonic days of MetaTrader and the MQL coding language.