I bet you didn’t know that in the Forex market, having emotional balance is not just an advantage, it is a necessity?

So why is that? Well, emotional balance helps Forex traders keep a clear mind, enabling then to make informed decisions rather than decision-making driven by fear or greed that can cause large losses.

In this article, written here at Axcess FX, we we will look at some important steps for staying emotionally balanced when trading Forex. They include identifying psychological bias in trading, strategies to overcome emotional challenges and creating a resilient trading plan.

If you read write to the end we have also included some bonus tips to further keep you trading in a balanced way.

What Is Psychological Bias In Forex Trading?

The first step to mastering the Forex market and achieving long-term success is to recognize the psychological aspect of trading. There are two primary psychological biases that can significantly impact on trading decisions:

Overconfidence in trading

Overconfidence takes place when a trader has such a strong belief in their own trading strategy and market research that they ignore contrary qualified evidence or fail to recognize high risk trades. An overconfidence bias can lead to excessive risk taking and deviating from a well established trading strategy.

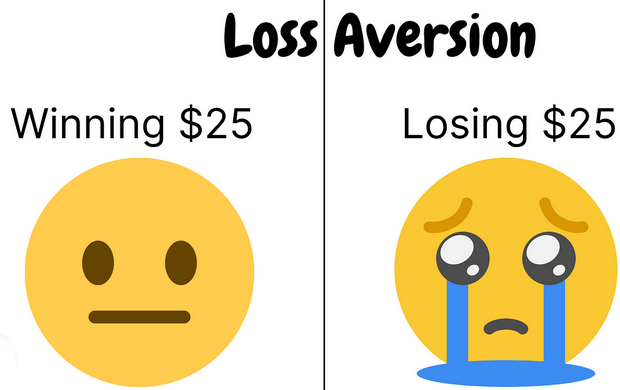

Risk aversion when trading

The opposite to overconfidence is risk aversion. Some Forex traders are overly cautious, and fear loss more than the prospect of making gains. An aversion to risk can result in:

- Prematurely exiting profitable trade positions with small gains when there is clearly more upside profit still on the table.

- Completely avoiding trade placements with strong profit potential due to an overriding fear of loss.

Understanding and acknowledging both of these psychological biases in trading is vital for developing solutions to mitigate their effects. For more in-depth research on psychological biases, Southern Taiwan University have written a research paper published in Scientific Research on the impact of psychological bias on trading behavior.

The Impact of Psychological Bias on Trading Decisions

The impact of psychological bias on trading decisions can often lead to less than optimal outcomes. To demonstrate this, we have put together two real-life scenarios illustrating both overconfidence and risk aversion.

The Overconfidence Trap

Consider the case of Mike, a trader specializing in USD/JPY who has been on a seven week winning streak. Encouraged by these recent successes, Mike starts to feel that every trade he makes will result in substantial profit. Unfortunately, his overconfidence sees him ignore clear signs of an imminent reversal in the Yen.

Instead of keeping to his successful trading strategy, which is indicating caution in these volatile market conditions, Mike increases his position size using excessive leverage, convinced of his ability to keep winning. Unfortunately, the Yen does not conform to Mike’s expectations, and a significant reversal from 150.50 to 148.25 results in a large loss of 30% of Mike’s capital account as his long USD/JPY position is stopped out.

This simple scenario underlines how overconfidence can blind traders to the reality of the market, causing them to take unwarranted risks.

The Fear of Loss

Jen is a EUR/USD trader who is on the other side of the emotional spectrum to Mike, as after a few profitable trades, she has become too cautious. Terrified of losing her gains, Jen is now concerned over the most minor of market fluctuations. This fear of loss prompts her to continually exit well-positioned trades early and lock in small gains, instead of letting a winning trade run for maximum profit.

It is only later, as the very trade she exited early, moves in the direction she anticipated that Jen understands a fear of loss prevented her from achieving substantial gains.

The case of Jen demonstrates how the fear of losing, or risk aversion can lead traders to give up significant profit in favor of smaller, guaranteed returns.

The balance between overconfidence and the fear of loss is a fine line. Traders must recognize their susceptibility to potential biases and work hard to prevent them from compromising a sound trading strategy.

Strategies to Overcome Emotional Challenges

Employing strategies to overcome emotional challenges can better help maintain an emotional balance and more rational decisions leading to improved outcomes and greater trading success. We will take a broad look at some approaches that can help.

Develop mental discipline

Without mental discipline, you will never succeed as a Forex trader. The very essence of trading is to analyze the market to find profitable trades and based on this analysis, create a consistent trading strategy accounting for goals and interests.

Changes in market conditions can result in poor decisions and actions which are driven by the emotion of the moment. In such circumstances, it is vital to maintain restraint and you can do this by trading according to a predetermined trading strategy. Discipline is the repeating of actions to produce positive results. These actions may at times be difficult and require some effort and so following a trading plan is vital and we will cover building a trading plan in the next section.

Practice mindfulness and meditation

- Mindfulness is staying in the present and being aware of your thoughts and emotions without letting them control your actions. Mindfulness can help you recognize if you are reacting out of psychological bias rather than trading based on logic.

- Regular meditation can help reduce stress, improve focus and help maintain emotional balance by enhancing decision-making when trading under pressure. Perhaps develop a pre-trading routine by engaging in activities that calm your mind before you start trading, including meditation, listening to calming music or a short walk

Mindfulness meditation in 5 minutes video

Take breaks from trading

Taking regular breaks from trading is vital for your mental health and performance. Breaks can prevent burnout by giving you time to relax and recharge. Breaks also provide perspective, allowing you to return to trading with a fresh set of eyes and potentially new insights into the market.

During your breaks, stay physically active, as regular physical exercise can reduce stress and improve your overall mental health, contributing to better decision-making. For more in-depth information on preventing burn out when working, healthline.com have written a useful resource.

Build a Resilient Trading Plan

Now that you can broadly identify psychological bias and can include strategies to overcome emotional challenges, another part of staying emotionally balanced while trading Forex is to have a resilient trading plan that doesn’t break down.

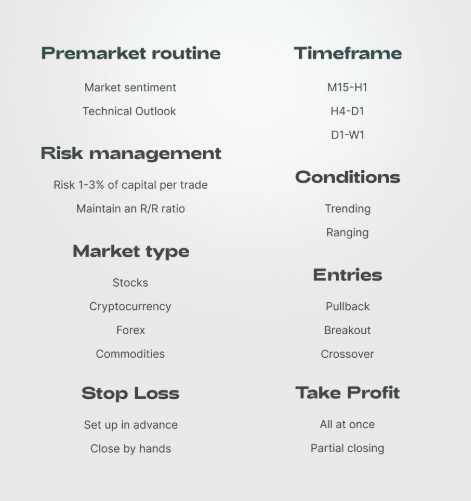

Trading plan considerations

A trading plan is the cornerstone of a successful Forex trading strategy serving as a guide to your trading methodology, risk management rules, and financial objectives. Adherence to a strict trading plan is the difference between success and failure in volatile Forex trading and at Axcess FX, we have identified four key components that make up an effective trading plan.

What are your trading goals?

Lay out exactly what you want to achieve in your trading, both on a short term and a long term basis. It will provide you with targets that are reference points. Short term can actually relate to achievements on each trade, with long term perhaps relating to what you want to achieve over a trading year or even longer.

Put in place proper risk management

Identify how much of your trading capital you are willing to risk on a single trade, and do not deviate from it. We have written a useful article on the importance of risk management in Forex trading which you can read here.

Entry and exit criteria on all trades

Specify the conditions under which you will enter and exit Forex trades, including technical indicators, price patterns, or economic events that you will use as signals.

Trading performance evaluation and adjustment

Include a process for regularly reviewing your trading performance and adjusting your plan as necessary. A trading journal can be part of this process and we will touch upon this later in the article.

Adhere to your trading plan

Staying disciplined and managing your expectations are vital for adhering to a trading plan, especially in the face of market volatility or after a losing streak. Over the course of our trading careers, here at Axcess FX, we have found three beneficial ways to help keep within the confines of your trading system.

- Commit to a daily routine: Establish a daily trading routine that includes reviewing market conditions, checking economic calendars, and planning your trades according to your trading plan.

- Maintain emotional Control: Recognize when emotions like fear or greed are influencing your decisions and take steps to refocus on your plan which you know has been created using logical thinking.

- Have patience: You should understand that not every trading session provides trading opportunities that fit your trading parameters. Having the patience to wait for the right moment is an integral part of trading.

Exercises to Improve Decision-Making

Improving your decision-making skills as a Forex trader is essential and here are some exercises that can help:

Analyze trading scenarios

You can use historical market data to practice on by simulating trading scenarios. For example, analyze how different strategies would have performed in a specific market condition on a specific currency pair and the reason for each performance.

Try to also plan for different outcomes, so for each potential trade, try and consider the worst and best-case scenarios; it helps prepare mentally for any market movement and taking the appropriate money management course of action.

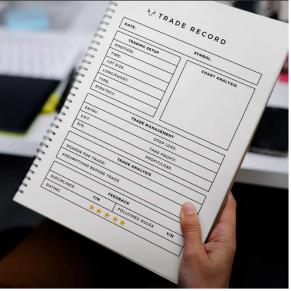

Keep a trade journal

Document every trade in a trading Journal including your rationale, the outcome, and any psychological bias that influenced your trading decision. Reflecting on this information can offer crucial insights into your Forex trading habits and help you further refine your trading strategy.

We would recommend setting aside time periodically (perhaps weekly or monthly) to review your trade journal entries. What you are looking for are patterns in your trading behavior that can be improved for greater trading success.

Learn from your losing trades

Instead of dwelling on losing trades, view losses as an opportunity to learn. Try and analyze each losing trade to see what went wrong and how you can avoid the same errors in the future. Also use the insights gained from your trade analysis to make informed adjustments to your trading plan.

Additional Practical Tips for Maintaining Emotional Balance

Here are three further tips to help you stay centered and focused for better trading:

- Set realistic expectations: Understand that losses are part of trading and set realistic expectations for wins and losses when you are setting the parameters for your bullet-proof trading system.

- Use stop loss orders: Always protect your trades with stop loss orders to manage risk and prevent emotional decision-making in response to volatility in the market.

- Seek support: Join trading communities or forums where you can share experiences, seek advice, and gain support from fellow traders. A supportive trading community can provide not only friendship but also different perspectives on trading strategies and emotional management. We have a guide on some good Forex resources online including where you can access community support and trading knowledge.

Written by Chris Gillie

Chris Gillie is the founder of Axcess FX, a Forex software review and research website. He is a former investment banker who worked in FX Sales on the UBS London trading floor. Chris has been using Forex trading software as part of his trading set-up since the late 2000s and the embryonic days of MetaTrader and the MQL coding language.