Forex charting software is a specialized tool designed for traders to predict currency movements through a snapshot of past and current market conditions. It aids with predictive analysis, which is the use of data to anticipate future trends to help power strategic decisions.

The purpose of this Axcess FX guide is to provide the top 5 best Forex charting software solutions available in 2026, identified from our research and chosen according to strict requirements.

Our guide will also highlight broader considerations that together will help you make an informed decision regarding the correct charting application for your needs.

Selection Criteria For The Best 5 Forex Charting Software

We have set out three requirements that must be offered by a charting software provider to be considered on our ‘best of’ list.

| SELECTION CRITERIA |

|---|

| 1. Connectivity to Forex Broker Platforms |

| 2. Trade directly from charts |

| 3. Code your own technical indicators and strategies |

Our Selection Criteria Explained

Forex is the fastest moving financial market. The ability to react fast requires the use of charting software with low latency from data feeds for rapid analysis and the capability to place trades straight from charts for direct execution via a connected Forex broker platform.

To succeed as a Forex trader, it is vital to have advanced charting tools that have the capacity to work with your trading strategy and not hinder it. Traders using advanced trading strategies may need to code custom technical indicators and strategies created through scripts as built-in indicators do not meet their requirements.

The 5 Best Forex Charting Software Solutions

Here are the 5 Best Forex Charting software for 2026 according to our selection criteria. The table below contains key information at a glance and we will look in depth at each software solution later in the guide.

| Forex Charting Software | Connect To Brokers | Trade Direct From Chart | Code Your Own Indicators | Desktop or Web-Based | Own Mobile App | Free Trial | Price Plans From Per Month | More Info |

|---|---|---|---|---|---|---|---|---|

| TradingView | Yes | Yes | Yes | Desktop & Web-Based | IOS + Android | 30-Day | $49 | Try For Free |

| TrendSpider | Yes | Yes | Yes | Web-Based | IOS + Android | 7-Day | $39 | Try For Free |

| eSignal | Yes | Yes | Yes | Desktop & Web-Based | IOS + Android | 30-Day | $51 | Try For Free |

| MultiCharts | Yes | Yes | Yes | Desktop | No | 30-Day | $66 | Try For Free |

| MetaTrader Charts | Yes | Yes | Yes | Desktop & Web-Based | IOS + Android | Free | Free | Try For Free |

The Main Functions Of Forex Charting Software

As a specialist application for Forex traders to anticipate currency pair moves, the primary functions of Forex charting software include:

Graphical representation of currency prices

At its core, charting software provides a graphical representation of Forex prices over specific periods. Whether it is major currency pairs or currency crosses, charting applications can display minute-by-minute price changes or long-term trends over years.

Collecting and plotting price feeds

The software gathers real-time data from various market sources. Using this data, it plots price points at regular intervals, forming recognizable patterns like candlesticks, lines, or bars. This continuous data feed ensures traders have up-to-date information at their fingertips.

Real-time observation

The real-time observation of Forex currency price movements through chart updates is a huge benefit for Forex traders. This immediacy allows traders to make informed decisions swiftly.

Analytical tools

Forex trading software typically comes equipped with additional analytical tools like technical indicators. Technical indicators range from simple moving averages to more complex mathematical calculations like Bollinger Bands, Fibonacci Retracement and Stochastic Oscillator. They can be invaluable for traders to predict future price movements.

Considerations for Choosing the Right Forex Charting Software

Selecting the right charting software is crucial for a Forex trader as it can significantly impact on trading efficiency and profitability. There are two important considerations to consider:

What are the charting needs for your trading style?

All forex traders will have differing strategies, risk appetites, and goals. The charting software employed will also need to align with the trader’s specific trading system, offering the relevant tools and views.

As a working example, we are going to consider day trading. Day trading, where positions are opened and closed in the same day requires quick decisions and has different data requirements to position trading, where positions can be held for months.

Essential features from any charting software for day traders include:

- Real-time data feeds

- Low latency

- Connectivity for fast order execution

- A user-friendly interface.

- Short-term time frames and relevant indicators.

- Social collaboration

TradingView, known for its fast and reliable real-time data and community-driven insights is a favorite among many day traders where traders can share and learn from real-time analysis.

What should high quality chart software include?

High quality charting software should be feature-rich and have user-friendly functionality to cater to both newcomers and expert traders. We would expect a robust charting solution to include:

- Historical and real-time data from multiple sources

- Advanced technical indicators featuring overlays and oscillators

- Advanced drawing tools

- A scripting language to code bespoke indicators

- Customizable interfaces

- Backtesting and forward testing capability

- Social collaboration

- Trade directly from charts

- Trading integration with global broker platforms

- Multi-device access via desktop, web and mobile app

- Mobile app availability on both IOS and Android

- Multiple pricing plans to cater for different needs

Stand-Alone Forex Charting Software Or A Built-In Broker Tool?

Online broker platforms will typically have built-in charting software which often suffices, particularly for newcomers to trading. Other traders, however will opt for stand-alone charting software that plugs into but sits outside the broker platform.

So why would you consider using external software versus a built-in broker charting solution?

The limitations of built-in charting software on trading platforms

Not all trading platforms are created equal with some offering comprehensive charting capabilities and others providing a more rudimentary view. Limitations hinder a trader’s ability to analyze the market effectively and may force them to use stand-alone charting software also called a third party solution.

The best stand-alone chart software provides data quality, analytical levels and customization options using the same sources and tools as institutional level trading desks. For example, regarding data quality, built-in broker charting solutions may only use a single data-source for real-time and historical data, whereas stand-alone software may have access to multiple data feeds enhancing the choice and caliber of data to analyze.

The need for a specific analytical tool

Forex trading is not just about observing price movements but also involves predicting future trends with a high degree of accuracy. To do this, Forex traders rely on advanced analytical tools including technical indicators and algorithmic models to identify potential trading opportunities.

A complex trading strategy may use a specific technical indicator that is only available through a specific third-party charting solution and not on the broker’s own built-in charting solution.

Device compatibility issues and solutions

Traders are not just operating from desktops and now many trade on the go, using tablets and smartphones. Unfortunately, not all charting software is optimized correctly for all devices and this lack of compatibility can be a significant hindrance, especially for traders who rely on real-time data.

Solutions often involve cloud-based software or dedicated apps for different devices, ensuring traders have constant access to their charts. Good charting software will provide high quality functionality irrespective of whether a user accesses their solution using desktop, web or mobile.

Paid versus Free Forex Charting Software

Forex traders are often torn between paid and free charting software with both options coming with their own pros and cons:

The advantage of premium features

Paid software usually offers advanced features, premium customer support, and more extensive historical data. The added functionality can be crucial for serious traders, offering them a trading edge.

The limitations of cost-effective solutions

Free software options offer extensive functionality but might come with limitations, such as fewer indicators, pop-up ads, or delayed data feeds, which is hugely disadvantaging those jobbing the market.

Mobile Charting Applications

In today’s digital age, the ability to trade on the go is invaluable, however, mobile charting comes with its set of challenges.

Limitations with mobile Forex charting

There are three limitations that are difficult to overcome and hinder the mobile trading experience. They are screen size limitations, reduced processing power, and the risk of intermittent internet connections when using 4G or 5G networks.

Mobile app functionality and availability on Android and iOS

For a full mobile experience, a charting software provider needs to offer its mobile app on both the Android and IOS operating systems to service the needs of both Apple and Android phone users.

Not all providers, however have the resources to offer a mobile charting app for both operating systems. Even if they do, does their Mobile app mirror the desktop or web experience, ensuring traders have all essential tools at their fingertips, even on the move.

The Best Forex Charting Software In Detail

There are a number of well-respected stand-alone Forex charting software solutions worth considering outside of the confines of your broker trading system. We will look at the top 5 according to our ranking criteria.

TradingView

TradingView has been around for over ten years, since its creation in 2011. It is a respected player in the charting software arena and used by over 50 million traders and market participants worldwide. It has API integration to major broker platforms including Interactive Brokers.

Traders can view real-time charts and overlay with more than 80 different technical indicators and over 50 drawing tools. You can further create custom indicators using the platform’s scripting language called Pine Scripts. There is also a strategy tester tool for recreating strategies and backtesting using TradingView’s historical data, which goes back more than 50 years.

TradingView has a very strong social community. The collaborative environment allows traders to share their analyses, custom scripts, trading signals, comment on others’ views, and follow expert traders.

The main benefit of TradingView

TradingView has advanced charting features, providing access to charting tools unavailable on other charting software, such as the ability to automatically draw advanced harmonic patterns like 5-point retracement structures.

TrendSpider

TrendSpider is a relative newcomer to the Forex trading community, with the platform having been founded in 2016. It provides access to advanced charts and real-time data with over 200 built-in indicators to undertake detailed technical analysis.

Like TradingView, TrendSpider also allows for the creation of custom indicators through its own JavaScript scripting language. The software allows you to backtest trading strategies directly on the relevant price chart and even deploy any backtested strategy into its own automated Forex trading robot.

TrendSpider connects to over 20 broking platforms, including Oanda and Interactive Brokers via the SignalStack plug-in, where trading alerts created on charts can be turned into automated trades.

Main benefit of TrendSpider

The key benefit of TrendSpider is how it automates the leg work of time-consuming manual technical analysis. It has a Smart Chart capability which instantly detects trend lines and chart patterns automating.

eSignal

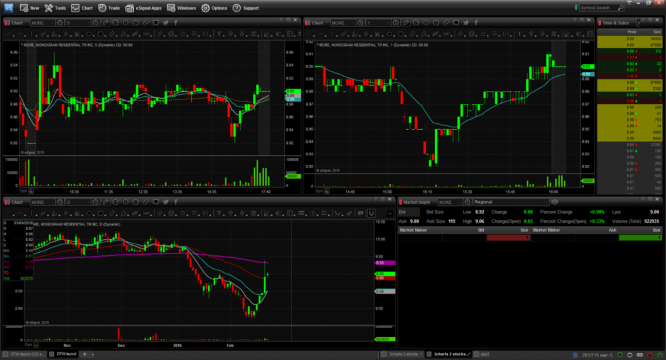

eSignal is an advanced charting solution with full integration to over 50 well-known broker trade execution platforms including the Interactive Brokers’ Trader Work Station TWS. The ability to trade from within the eSignal platform greatly streamlines the trading process, critical for professional traders.

The software provides access to hundreds of technical indicators and advanced drawing tools like regression trend and time cycles. eSignal like TrendSpider uses JavaScript as the base for its scripting language, allowing traders to create their own indicators.

eSignal is also widely known for its extremely fast, real-time market data feeds and accuracy. With the platform continually network staffed around the clock, the reliability of the software is proven to perform at all times, including periods of high volume.

Main benefit

As eSignal is owned by the same company that runs the ICE Futures Exchange, the low latency in real-time feeds and the data quality are excellent with strong reviews. It allows for charting analysis through to trade execution with little lag, vital for all levels of trader.

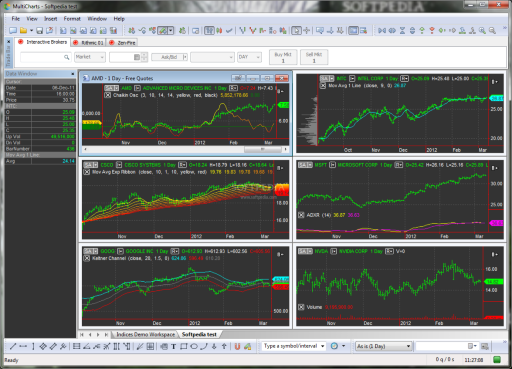

MultiCharts

MultiCharts was founded in 2005 with the aim of providing deeper charting analysis than was offered on broker platforms at the time by combining multiple sources of third-party historical data with real-time data. Today, MultiCharts accesses 20 different data vendors for its data feeds giving access to extensive historical and real-time data.

It has connectivity with a significant number of major brokers including Oanda and Dukascopy allowing trade execution straight from charts. With its visual chart trading, MultiCharts allows for orders to be dragged and dropped directly onto a chart. The charts are also context sensitive where movements of the mouse are tracked allowing trade placement at any level clicked on.

Like other high quality charting software, Multicharts has its own proprietary coding language called PowerLanguage allowing traders to create their own indicators and trading strategies.

Main benefit

The main benefit of Multicharts is the extensive level of data pulled from multiple data vendors and then the accessibility of that data. It combines real-time data from one provider with historical data from another, in one or more sub-charts, offering the flexibility to meet the needs of all trading systems.

MetaTrader Charts

MetaTrader is long-established in the Forex trading community particularly with its MT4 platform. The platform is free to download from the MetaTrader website and provides substantial charting tools. As well as charting, MetaTrader is also the underlying trade execution platform used by many online brokers like Forex.com.

Due to its user-friendly interface, Metatrader charts is very easy to use. For new traders simplicity and flexibility are key to its popularity. Although the interface looks dated it is straightforward to quickly access and customize the appearance of charts.

For experienced traders, the flexibility of MT4 Charts is attractive, including the ability to tweak the interface, add or remove tools, and incorporate third-party plugins. Furthermore, with its MetaQuotes coding language, called MQL4, the software also allows traders to develop their own technical indicators of high complexity.

Main benefit

The standout benefit of MetaTrader are its customization capabilities, particularly the ability to code your own technical indicators and automated strategies.

What Charting Software is Used by Expert Traders

When it comes to professional Forex trading, expert traders need charting platforms that offer a blend of reliability with advanced features and adaptability. As the Forex market is ever-evolving, with new trends and patterns emerging regularly, expert traders value software that:

- Is adaptable, allowing them to incorporate new tools or adjust their strategies swiftly.

- Has advanced features, such as automated trading or custom scripting that can provide a competitive edge.

Many expert traders gravitate towards charting software offered by TradingView, eSignal and MultiCharts as these solutions are:

- Stable, minimizing any downtime

- Offer good integration with trade execution platforms

- Have established real-time data feeds with low latency from widespread data vendors.

- Offer a comprehensive suite of tools, ranging from advanced technical indicators to algorithmic trading capabilities.

Final Words

Our guide identifies the best Forex charting software and also discusses the broader considerations for selecting the right solution for your needs. The merits of using stand-alone software with integration to your broker are compelling, although built-in broker charting software is often sufficient for newbies.

Irrespective of whether you are a newcomer or an experienced Forex trader, it is vital to employ the right software for your individual Forex trading system.

Written by Chris Gillie

Chris Gillie is the founder of Axcess FX, a Forex software review and research website. He is a former investment banker who worked in FX Sales on the UBS London trading floor. Chris has been using Forex trading software as part of his trading set-up since the late 2000s and the embryonic days of MetaTrader and the MQL coding language.