Foreign Exchange is the fastest moving financial instrument and long hours trading Forex can punish you and risk burnout.

The more volatile currency pairs like Cable (professional trader jargon for GBP/USD) are particularly demanding and any market-affecting news can sometimes result in large intraday moves or even a gaping market.

Subsequently, it is extremely hard to stay focused trading for hours at a time, especially in a volatile market; unfortunately, due to the very nature of Day Trading it is necessary to trade the market multiple times a day to make money, so how is it possible to stay focused day trading Forex?

15 Tips On How To Stay Focused Trading Forex

We have created a list of 15 pointers on how to stay focused day trading Forex and by adopting even a small number of these widely known suggestions will put you on the right path to improved focus and greater trading success.

1. Keep trading hours down by trading at peak times

To stay focused in Forex, you need to find a way to keep trading hours down. One way is to build up a feel for when a particular currency pair is moving more or when it is static. For example, Cable (GBP/USD) is more volatile in the early to mid-European session than any other liquid pair. For a day trader, by taking advantage of the price swings of Cable for a short time instead of trading a currency pair that constantly shows no movement makes sense.

Why spend all day staring at a screen when you can be fully focused trading for just three, four or five hours a day? Furthermore, trading when volume and volatility are highest increases the likelihood of your trades being executed at the best prices.

2. Optimize your trading environment and stay physically comfortable

It is good practice to arrange your trading space so it minimizes distractions:

- Use ergonomic furniture, particularly a high quality chair and desk that prevents discomfort and allows you to maintain a posture that prevents strain or injury. Physical discomfort can quickly become a distraction, so it’s important to address it proactively.

- Employ multiple monitors to keep important information visible; you may be tracking multiple time frames or keeping track of the flow of orders; but avoid cluttering your space with unnecessary devices.

- Keep your trading area tidy and your resources well-organized. An orderly workspace can lead to an orderly mind, which is essential for focused trading.

3. Pre-market preparation and routine

By having a consistent daily routine that signals the start of your trading day helps compartmentalize your trading activity and can improve as a Forex trader your focus and discipline.

Start your daily routine before every trading session by reviewing the previous day’s market performance, any overnight news, and any economic data due for release. Analyze prospective currency trades based on this information and adjust your trading plan for the day accordingly. Solid preparation helps you anticipate market movements and sets a focused agenda for the day.

Regarding news and economic data, try and limit news sources to a select few reliable financial news outlets to avoid information overload. Too much information can be distracting and can lead to analysis paralysis.

4. Set daily trading targets

As a day trader it is vital to adhere to your established profit goal and maximum draw down limit for each trading day. These should be in accordance with your established trading strategy, which takes into account the trading capital available in your broker account and risk tolerance levels. Once you hit your profit target, or your losses reach a certain level during the trading day, stop trading to preserve capital and mental energy.

5. Limit the number of open positions

Manage a comfortable number of open positions to ensure you can react appropriately to market changes. For less experienced traders, a one-by-one strategy would be best suited so that the outcome can be analyzed before opening a new position.

Overextending yourself can lead to missed signals and poor decision-making. You also have to take into account that you do care about all your open positions even if stop-loss or take-profit orders are in place.

6. Implement Risk Management for greater focus

Always apply stop-loss orders and position-sizing to manage exposure to any single trade. The percentage of the capital that you are prepared to lose per trade and the size of each position accounting for leverage should be consistent with you wider-established trading system. By automating strict risk management on each trade will allow you to focus on the markets because you are not worrying about individual losses. By staking at most 1% of your capital per trade is good practice to trade Forex profitably.

7. Take time out with short or long term breaks

Taking time out is not an easy decision to make as a day trader, where trading involves high turnover with narrow margins to generate a profit at the end of each trading day.

Try and schedule short breaks to step away from the computer, especially after a stressful trade. It can prevent fatigue and help maintain mental clarity throughout the trading day. Also, recognize when emotions are influencing your decisions and if you find yourself feeling overly stressed or emotional, take a break to avoid impulsive trades.

Do not be afraid to take longer breaks of hours or even days if you are on a losing streak or when you feel under pressure. By taking a trading break away from the market can be refreshing and will recharge you.

8. Stay hydrated and nourished

Keep water and healthy snacks within reach to maintain energy levels and cognitive function, as dehydration and hunger can lead to decreased concentration and poor trading decisions. A report by News-Medical on the levels of hydration and cognitive function confirms that adults who only consume around 1 liter of water a day will suffer poorer concentration, an increase in reaction times and short-term memory losses, all significant disadvantages for a day trader.

9. Practice mindfulness and breathing exercises

By engaging in mindfulness practices and breathing exercises to manage stress and anxiety can assist your trading. It can help you maintain a calm, clear head for making quick, rational decisions. A useful resource written by HawaiiPacificHealth.org offers 8 useful mindfulness techniques that also reduce stress.

10. Maximize the use of technology and trading tools

Utilize your trading platform and charting software efficiently to set up automatic alerts for price levels, technical indicators, or news events. It will allow you to monitor multiple markets or positions without losing focus on any task at hand by having to constantly watch the screens.

Advanced charting software, now allows you to set alerts and place trade orders directly from a chart, greatly streamlining the analysis to trade placement process. We have written a comprehensive guide on the best charting software.

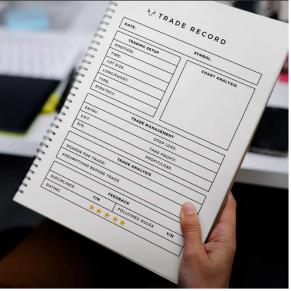

11. Keep a Trading Journal

By periodically reviewing a trading journal can help you refine your strategy and stay focused on what works. Document all your Forex trades in detail. Although your broker will have a record of the P&L of each trade, your journal is better as you will have a detailed historical record. The record can be as in-depth as you make it and may include:

- Which chart time-frames gave you the best profits

- The rationale behind the trade

- Trade execution levels

- The success of each trade

- Which currency pairs were the best performing

- Support and resistance levels

12. Avoid Multi-tasking

Focus on one task at a time, whether it’s analyzing a chart, reading news, or executing a trade. Multitasking, where we are repeatedly switching between tasks is fatiguing for the brain. A Forex trader may be susceptible to high media multitasking where there is a risk of using more different devices simultaneously.

It may lead to a number of errors and missed opportunities, which for Forex traders directly affects bottom line profitability. Lifespan have written a report on how multitasking affects your brain health which you can read here.

13. Continuous Learning

The Forex market is continually evolving with emergence of new technologies, strategies and trends. The first part of continuous learning is to keep abreast of developments in the market and adapt if necessary to keep your trading edge.

The second part of continuous learning is to spend time at the end of each trading day reviewing your trades and the day’s market action. You can use this time to learn from both your successes and mistakes, which can help sharpen your focus for the next trading day.

14. Use Positive Reinforcement

Positive reinforcement is the rewarding of certain behaviors, which results in a positive outcome. As a Forex trader, you can take advantage of positive reinforcement. For example, reward yourself for following your trading plan and maintaining discipline, regardless of whether you had a winning or losing day. It can reinforce good habits and keep you motivated.

15. Having a balanced Life with trading:

A balanced life is not just about an equal split between trading and your outside life, but ensuring that in both of these areas you are happy and fulfilled.

- Do you still have time to enjoy your hobbies while you trade profitably?

- Does excessive trading affect your ability to sleep?

- Do you have enough time to eat properly?

Traders who have a healthy work/life balance are more likely to be well rested and less stressed to stay productive and for longer and keep your mind sharp for making trading decisions. The impact of burnout because of a poor balanced work life makes you less productive because of fatigue and the subsequent loss of focus and concentration.

Focus, Focus, Focus

By taking on board some of these tips, you can create a robust framework to help maintain focus and discipline in the fast-paced world of Forex day trading, In accompaniment to this article, below is a useful video that discusses the mental side of Forex trading including maintaining focus and dealing with the fear of missing out.

Written by Chris Gillie

Chris Gillie is the founder of Axcess FX, a Forex software review and research website. He is a former investment banker who worked in FX Sales on the UBS London trading floor. Chris has been using Forex trading software as part of his trading set-up since the late 2000s and the embryonic days of MetaTrader and the MQL coding language.